Singapore's Critical Illness Protection Gap Narrows While Mortality Protection Gap Remains Relatively Unchanged: Protection Gap Study 2022

- Platform Workers found to have bigger protection gaps compared to the general Economically Active population

- Life Insurance Industry commits to spearheading efforts to narrow the protection gap in Singapore

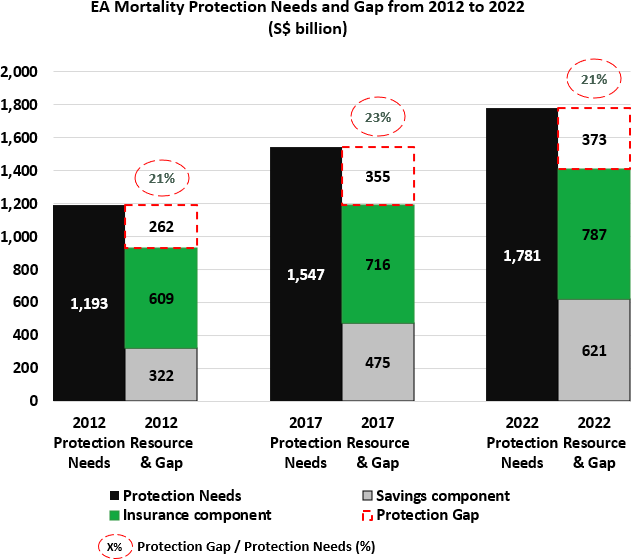

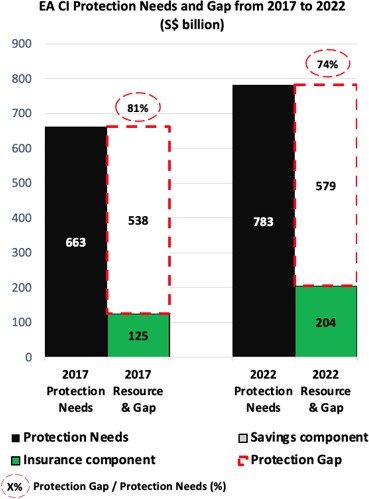

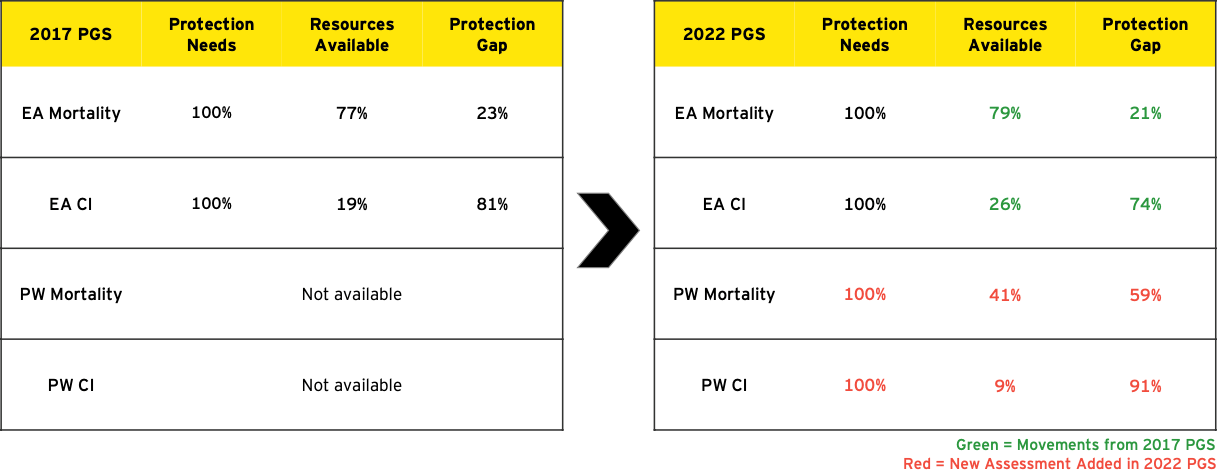

SINGAPORE - Media OutReach - 8 September 2023 - The Life Insurance Association, Singapore (LIA Singapore) today unveiled findings of the Protection Gap Study (PGS) 2022 which found that economically active1 (EA) Singaporeans and Permanent Residents in Singapore – including Platform Workers (PWs) - had a S$373 billion mortality protection gap2 and a S$579 billion critical illness (CI) protection gap3.

This equates to a 21% mortality protection gap and a 74% CI protection gap in Singapore in 2022. The study comprises two components: analysis of policy data from life insurers, as well as a supplementary market survey of 775 EAs.

PGS 2022 provides insights for the industry, life insurers and reinsurers, as well as other stakeholders

- including employers and relevant government agencies - to implement actionable strategies that will support individuals to meet their protection and financial planning needs. This is especially important given the extended life expectancy4 as well as an unpredictable socio-economic landscape5 facing the community today.

LIA Singapore also included the additional analysis of protection needs and gaps of PWs6 in PGS 2022, in recognition of this being a growing segment within the community. The average PW individual has bigger mortality and CI protection gaps than the average EA individual in Singapore.

Mr. Dennis Tan, President, LIA Singapore said, "The Protection Gap Study 2022 shows that while mortality and critical illness protection gaps persist, there has been progress recorded since our last study in 2017. There is greater awareness and appreciation of the value of insurance in Singapore, and more individuals are taking actions to better meet their protection needs.

1 Individuals employed and contributing to the production and distribution of goods and services. Platform workers fall within this category and are a subset of the economically active group.

2 The mortality protection gap represents the financial gap to cover needs of dependents over a defined period in the event of death. It is the amount of money required by dependents to cover expenses, clear outstanding debt, and maintain a reasonable lifestyle, less existing savings and insurance coverage for mortality, following the death of a member of the household.

3 The CI protection gap represents the financial gap to cover family needs during the assumed CI recovery period of 5 years, until the insured is able to return to work. It is the amount of money required to cover expenses and outstanding debt payments during the insured's CI recovery period, less existing insurance coverage for CI. It is to be noted that identified needs of dependents beyond the CI recovery period have been considered on the hypothesis that the insured may not be able to meet those needs when they do return to work (due to the assumed reduction in the insured's earning capacity).

4 'Life Expectancy Improved Over the Last Decade but Saw Declines Over Recent Years Due to the COVID-19 Pandemic' (May 22, 2023) SingStat Singapore. Available at https://www.singstat.gov.sg/-/media/files/news/press22052023.ashx

5 'MTI Narrows Singapore's GDP Growth Forecast for 2023 to "0.5 to 1.5 Per Cent"' (August 11, 2023) Ministry of Trade and Industry Singapore. Available at: https://www.mti.gov.sg/Newsroom/Press-Releases/2023/08/MTI-Narrows-Singapore-GDP-Growth-Forecast-for- 2023-to-0_5-to-1_5-Per-Cent

6 'Platform Workers' in this study refer to a group of individuals consisting of 'Private-hire Workers', 'Taxi Drivers' and 'Delivery Workers'.

While this progress is encouraging, we know more can and must be done to support different members of our community, such as our Platform Workers. The life insurance industry will continue leading the charge on these efforts, leveraging insights from the study to inform initiatives for the Association, our member companies, and other relevant stakeholders to pursue and to get more individuals better insured."

Some areas the industry will explore developing initiatives for include:

- Enhancing the understanding and reach of insurance policies through product innovations and further simplification of policy-related materials

- Adopting a customer profile and needs-based understanding approach to develop tailored customer segment-led propositions, product solutions and distribution approaches aimed at supporting specific groups with medium to high protection gaps (e.g. underserved segments such as those that are less educated, and/or those of lower income)

- Boosting consumer awareness and understanding about protection through public education initiatives

- Making it easier for underserved members of the public (e.g. Platform Workers) to reach accessible touchpoints to better understand and address their protection and financial planning needs

Mortality protection gap remained relatively unchanged for EA individuals despite an increase in mortality protection needs

EA individuals in Singapore have approximately 79% of their mortality protection needs met. Though the mortality protection needs increased between 2017 and 2022 – primarily due to an overall increase in costs of living and number of EA individuals – the mortality protection gap remained relatively unchanged from 2017, with a slight 2% decrease from 23% to 21%.

This is largely due to income levels going up, increase in Central Provident Fund (CPF) and other savings by 47%, as well as an 11% uplift in life insurance coverage.

The average mortality coverage per policyholder increased by approximately S$41,100 to S$331,200 in 2022 which is approximately 3.6 times of average annual income. Policyholders in Singapore have an average of three policies for mortality protection.

CI protection gap for EA individuals narrowed primarily due to an increase in CI coverage

The CI protection gap amongst EA individuals has narrowed by a notable 7% - down to 74% in 2022 from 81% in 2017. The average CI coverage per policyholder increased by approximately S$64,400 to S$193,300 in 2022. This is approximately 2.1 times of average annual income.

This reduction in CI protection gap from 2017 was mainly driven by an approximate 63% increase in CI coverage since then.

On average, a CI policyholder owns less than one standalone policy. Their CI coverage is generally from Whole-of-Life policies or riders with CI to supplement their main life insurance policies.

Bigger mortality and CI protection gap amongst Platform Workers because of lower savings and insurance coverage

PGS 2022 found that there is a 59% mortality protection gap and a 91% CI protection gap among PWs. This is primarily attributed to them having lower CPF and deposit savings, as well as lower insurance coverage as compared to EA individuals.

Takeaways from the supplementary market survey include:

- Many PW respondents indicating they are not covered under Group insurance offered by platform providers, with a further portion being unaware if they are receiving any Group Insurance coverage.

- PW respondents expressed interest for the life insurance industry to establish accessible touchpoints that they may visit to seek guidance and support for their financial planning journey and insurance protection needs. The industry recognises that these touchpoints could include roadshows at the offices of platform providers.

Comparison between 2017 PGS and 2022 PGS

Resources available include the aggregate of available savings (i.e. CPF savings, other savings such as cash and deposits) and existing insurance coverage

Note to editor: The full report is available at www.lia.org.sg

Hashtag: #LIASingapore

The issuer is solely responsible for the content of this announcement.

About the Protection Gap Study 2022

The Protection Gap Study (PGS) 2022 commissioned by LIA Singapore was conducted independently by Ernst & Young Advisory Pte Ltd. The study drew upon insurance data available until 31 December 2021 from insurers, coupled with public data analysis of economically active individuals in Singapore between the ages of 20 to 69 who have at least one dependent.

Key changes from the previous study are the inclusion of an inaugural protection gap study for the PW population, along with a supplementary market survey to gain deeper insights into the protection gap, thereby enabling a comprehensive reassessment of the assumptions that underpin the study.

Please be advised of key limitations arising from the assumptions and data sources used in the calculation of the mortality and CI protection gaps as these results reflect the average across Singapore, whereas each individual's circumstances will be different and specific to the individual. As such, individual protection needs should be analysed separately.

Another limitation of the study is that a significant portion of PWs sampled falls within the older age group. Nonetheless, the higher mortality protection gap and CI protection gap in comparison to EAs offer a valuable additional insight. This emphasises the importance of addressing the protection gaps among seniors, especially in light of Singapore's growing aging population.

Life Insurance Association, Singapore (LIA Singapore)

Established in 1962, the Life Insurance Association, Singapore (LIA Singapore) is the not-for-profit trade body of life insurance product providers and life reinsurance providers based in Singapore and licensed by the Monetary Authority of Singapore (MAS).Vision and Mission

The vision of member companies is to provide individuals with peace of mind and to promote a society where every person is prepared for life's changing cycles and for those situations unforeseen.They are committed to being a progressive life insurance industry by collectively enhancing consumer understanding, promoting industry best practices, and through the association fostering a spirit of collaboration and mutual respect with government and business leaders.

Values underpinning the association and its members

Unified in our resolve to deliver innovative solutions where every individual's needs are best met.

Professional in the way we conduct ourselves and in the counsel we give.

Ethical in ensuring our policyholders' interests are managed with utmost integrity.

Fair in how we strive to provide favourable outcomes to both our policyholders and shareholders.

Open & honest in all that we do to build an environment of trust and transparency.

Proactive in the steps we take to give our people the skills and knowledge to provide sound solutions at all times.