will Kwasi Kwarteng's plan deliver growth?

- Written by Steve Schifferes, Honorary Research Fellow, City Political Economy Research Centre, City, University of London

The UK economy has been dogged by slow growth[1] for a long time. Combined with even slower growth in productivity[2], it has meant virtually no increase in living standards for the average family over the past decade.

Now the new chancellor, Kwasi Kwarteng, has unveiled what he says is a radical plan to get growth back to its historic average of 2.5% per year. This would be an increase of about a percentage point, lifting living standards and providing more money for public services.

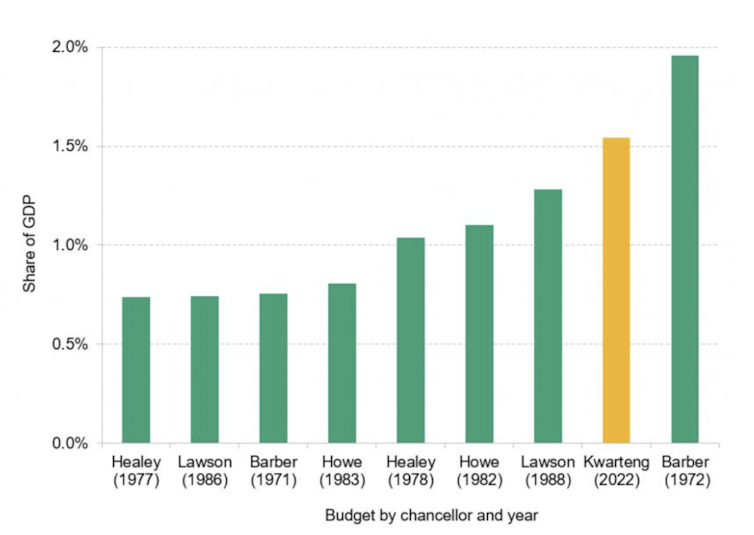

The central part of Kwarteng’s mini budget[3] involves cutting taxes in the hope of providing greater incentives for individuals and businesses to work harder and invest more, in what are the biggest net tax cuts from a chancellor since the early 1970s.

Much of this will benefit the better-off more than those on lower incomes, but the government argues that higher growth and not redistribution is the priority, and that this will benefit everyone as the economic pie becomes bigger. So will this work?

Net tax cuts of UK chancellors

Read more https://theconversation.com/mini-budget-will-kwasi-kwartengs-plan-deliver-growth-191285