Coface Asia Corporate Payment Survey 2022: Asian companies face rising credit risks despite shorter payment delays

No deterioration of payment delays despite the impact of COVID except in China

Improved economic conditions in 2021 contributed to a notable fall in the duration of payment delays across Asia-Pacific, dropping from 68 days on average in 2020 to 54 days in 2021, the lowest level in 5 years. The share of respondents experiencing overdue payment remained stable at 64% vs. 65% in the previous year. Among the nine economies covered, payment delays shortened the most in Malaysia and Singapore. By contrast, China was the only country that recorded a rise in payment delays, and also was the country with the longest average payment delay.

However, the survey highlighted some concerns. The share of respondents that mentioned an increase in the amount of overdue went up to 35% in 2021, against 31% in the preceding year. Furthermore, more companies reported ultra-long payment delays (ULPDs) of more than 10% of annual turnover, with this increase driven largely by China where the already high share of 27% in 2020 grew to 40% in 2021. The proportion of ULPDs slightly rose in Australia and India, while it stabilized or declined in the other six economies, with a significant drop in Hong Kong. The large majority of ULPDs are never paid, and therefore, cash-flow risks tend to increase when these ULPDs account for over 2% of a company’s annual turnover.

Sector-wise, the increase in companies experiencing ULPDs of more than 10% was particularly marked in the metals sector, for which it increased by 14 pp to nearly 23%, the largest registered among the 13 sectors. Other sector such as construction, ICT, transport and textile also face significant cash flow risks, with more than 30% of companies that experienced ULPDs reporting that such delays represented more than 2% of annual turnover.

Economic Expectations: Sustained optimism but high concern on rising material prices

Overall, optimism remains intact, with 71% of respondents expecting economic growth to improve in 2022. This optimism was, however, unequal across the region. Singapore is more optimistic compared to the Asia average, with 83% (+17 pp) anticipating higher growth. Companies in Japan and Thailand, where the recovery was relatively subdued in 2021 and therefore with a greater scope for a stronger recovery in 2022, showed more confidence as well, both rising by 14 pp to 75% and 80%, respectively. By contrast, this share was only 44% in Malaysia, showing a significant decline (-29 pp) as compared to last year amid rising political uncertainty, with the possibility of a snap general election in 2022.

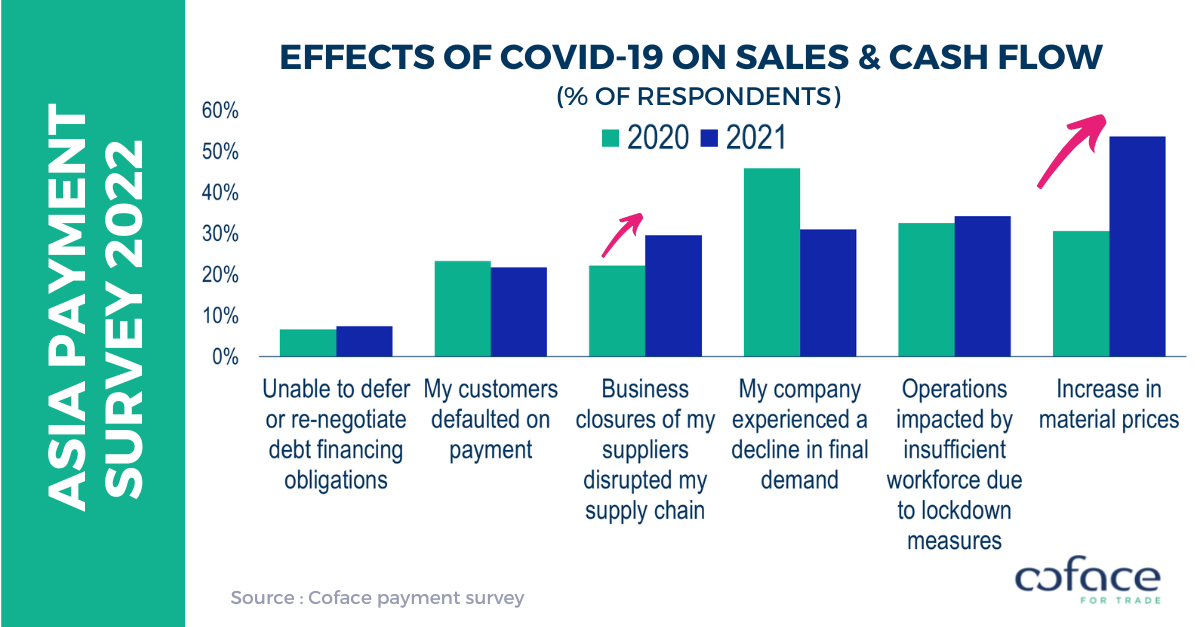

Rising raw material prices are increasingly mentioned by respondents when asked about the effect of COVID-19 on their sales performance and cash flow. Over half (54%) of the companies mentioned rising raw material prices as a key factor, up considerably from 31% in 2020. Raw material prices rose sharply in 2021, especially in crude oil, and were lifted significantly higher following the conflict in Ukraine. This intensified cost pressures for companies worldwide, including in Asia-Pacific, which heightened the risk of developing cash-flow problems.

Asian businesses margins increasingly under pressure

Nowadays, businesses are dealing with a complex environment characterized by supply chain disruptions, geopolitical tensions, and surging inflation. Supply constraints persisted in 2021, partly due to fresh COVID-19 outbreaks and new lockdowns. Nonetheless, the world gradually reopened and private demand rebounded. This widened the gap between demand and supply of many products and raw materials, leading to significant increase in prices. Global supply chain pressures slightly abated at the start of 2022, but were reignited by the Russia-Ukraine conflict. Given both countries’ predominant role in global commodity markets, the conflict has led to a further surge in raw material prices, pushing inflation higher and, in turn, wages as well. Consequently, it weighed on business profitability by increasing production costs.

After enjoying subdued inflationary pressures through 2021, Asian countries are now recording rapidly rising inflation, especially in food and energy items. In some Asian economies, consumer price index (CPI) growth rate has exceeded central bank’s target. This was the case in Thailand, where CPI posted an annual increase higher than the upper value of the central bank’s target band of 3% for the fifth consecutive month in May. Inflation target were also breached in Australia, India, and the Philippines. After having experienced deflation during 10 months over 2020/2021, Japanese inflation went above the Bank of Japan’s target with 2.5% in April. Facing this surge in living costs, some countries decided to increase wages in order to help consumers to deal with the situation. In Japan, South Korea and Singapore, data revealed that average wage growth has accelerated since 2021. In Southeast Asia, Malaysia introduced a large minimum wage hike of 35% in May 2022. A rise in minimum wage is also set to be implemented in the Philippines in June and in Vietnam the following month.

'Improved economic conditions in 2021 contributed to a notable fall in the duration of payment delays across Asia-Pacific. However, companies in the region faces rising credit risks, with more companies reported an increase in the amount of overdue. They were also more experiencing ultra-long payment delays of more than 10% of annual turnover, notably in China and, to a much lesser extent, in Australia and India.’, said Bernard Aw, Coface’s Asia-Pacific Economist.

Find here the Coface Asia Corporate Payment Survey 2022 produced by Coface.

COFACE: FOR TRADE

With over 75 years of experience and the most extensive international network, Coface is a leader in trade credit insurance and adjacent specialty services, including Factoring, Single Risk insurance, Bonding, and Information Services. Coface’s experts work to the beat of the global economy, helping ~50,000 clients in 100 countries build successful, growing, and dynamic businesses. With Coface’s insight and advice, these companies can make informed decisions. The Group' solutions strengthen their ability to sell by providing them with reliable information on their commercial partners and protecting them against non-payment risks, both domestically and for export. In 2021, Coface employed ~4,538 people and registered a turnover of €1.57 billion.

#Coface

The issuer is solely responsible for the content of this announcement.