what COVID is doing to commercial property it is about to do to super funds

- Written by Theodore Connell-Variy, Lecturer, School of Property, RMIT University

We’ve heard a lot about what the present crisis will do to home[1] prices[2], less about what it will do to commercial property[3] prices.

Commercial properties include office buildings, shopping centres, hotels and warehouses.

They account for 8%[4] of the assets of Australian super funds.

Melbourne’s Wesley Place commercial precinct is owned by a property trust.

Melbourne’s Wesley Place commercial precinct is owned by a property trust.

If their values drop (and they are falling) it will affect all of us, especially those about to retire or already retired.

Until COVID-19, commercial properties were widely regarded as safe investments. They offered both reliable income streams and capital gains as population growth increased the value of scarce real estate.

With the return on government bonds falling below 1%[5] they ought to be becoming more attractive, but offices are empty, their future uncertain, high end shopping centres are receiving less traffic, and hotels have entire floors unused.

Brisbane’s 1 William Street is owned by a superannuation fund.

Brisbane’s 1 William Street is owned by a superannuation fund.

In July the number of mobile phones active in Sydney’s central business district was down 52%[6] on January and February. In Melbourne’s CBD, before the stage 4 lockdown, mobile phone traffic was down 65%[7].

Data centres[8] are among the few commercial property bright spots – we are moving more data – along with distribution centres and regional shopping centres[9] – we are shopping online and closer to home.

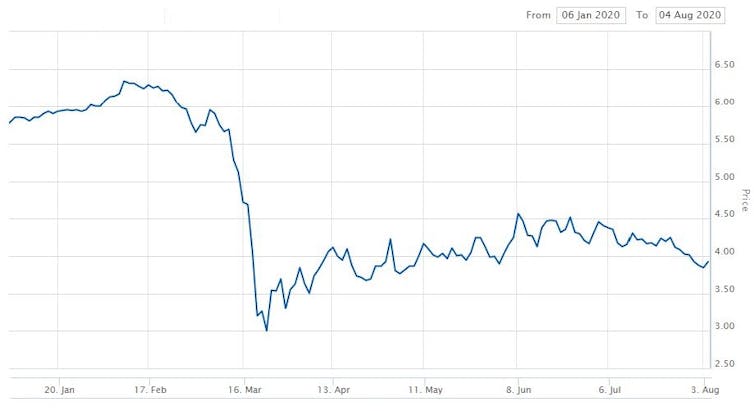

Over the course of the year the values of commercial property trusts listed on the Australian Securities Exchange have slid 29%[10], 32%[11], 34%[12],48%[13], 52%[14], and 69%[15].

Share price of GPT Group. GPT owns and manages retail, office and logistics properties.

Source: ASX[16]

Share price of GPT Group. GPT owns and manages retail, office and logistics properties.

Source: ASX[16]

For super funds with 8% of their assets in commercial property, a decline of 25% in values knocks 2% off their assets — A$54 billion across the industry as a whole.

In the only other big downturn since the advent of Australia’s superannuation system, the global financial crisis, commercial property offered the funds stability while shares were volatile.

Not so this time. The value of the commercial property is diving along with the stock market with just as uncertain a future.

References

- ^ home (propertyupdate.com.au)

- ^ prices (www.theguardian.com)

- ^ commercial property (www.commercialrealestate.com.au)

- ^ 8% (www.superannuation.asn.au)

- ^ below 1% (theconversation.com)

- ^ 52% (www.roymorgan.com)

- ^ 65% (www.roymorgan.com)

- ^ Data centres (www.smh.com.au)

- ^ regional shopping centres (www.smh.com.au)

- ^ 29% (www.asx.com.au)

- ^ 32% (www.asx.com.au)

- ^ 34% (www.asx.com.au)

- ^ 48% (www.asx.com.au)

- ^ 52% (www.asx.com.au)

- ^ 69% (www.asx.com.au)

- ^ Source: ASX (www.asx.com.au)

Authors: Theodore Connell-Variy, Lecturer, School of Property, RMIT University