Will New Zealand's $50 billion budget boost Jacinda Ardern's chance of being re-elected?

- Written by Grant Duncan, Associate Professor for the School of People, Environment and Planning, Massey University

New Zealand Prime Minister Jacinda Ardern has won global admiration for her personal style. But how will Kiwis judge her government’s performance at the ballot-box in September?

A major factor in that decision will be how well today’s budget is received – and how well it achieves its stated aim of “responding, recovering and rebuilding[1]” after COVID-19.

If she who was recently judged “the most effective leader on the planet[2]” gets dumped in the coronavirus fallout, then what are the chances for Donald, Boris or Scott?

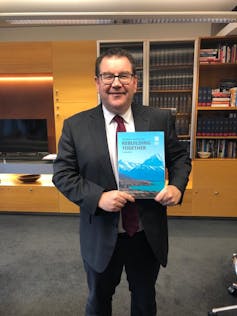

Finance minister Grant Robertson and the 2020 ‘Rebuilding Together’ budget, unlike any budget delivered in living memory.

NZ Parliament

Finance minister Grant Robertson and the 2020 ‘Rebuilding Together’ budget, unlike any budget delivered in living memory.

NZ Parliament

Late last year, finance minister Grant Robertson would have been expecting that May 2020 would see an optimistic Well-being Budget[3] Mark 2.

Instead, it’s turned into his “rainy day budget[4]”, as he abandons a conservative net public debt target of 20% of GDP. Debt is now projected to rise to 53.6% by 2023, as the government borrows to invest in jobs and runs deficits until at least 2024.

But budgets are political, not just technical, documents. With New Zealand’s general election still scheduled[5] for September 19, the question remains the same: pandemic or no pandemic, will this budget help Labour win a second term in office?

Read more: Past pandemics show how coronavirus budgets can drive faster economic recovery[6]

International observers were entranced by Ardern’s leadership after the March 2019 terrorist attack in Christchurch. But, while support for her and her party surged, this was only temporary[7]. By December, the centre-right National Party was polling[8] at levels that would see them form the next government.

Then the pandemic hit, and New Zealand went into strict lockdown in late March. A leaked poll[9] a month later put Labour on 55%, boosted by popular trust in the government’s decisive response to COVID-19.

But, like last year’s post-Christchurch surge, we should not assume this one will last either.

The economic crunch could flatten support for Ardern’s government by the time the election draws near. Budget 2020 is therefore critical to the maintenance of public confidence in the present government’s stewardship at a time of deep uncertainty.

Business confidence[10], which had dropped in late 2017 simply because Labour took office, understandably “plummeted” in April while the country was in lockdown.

It’s harder for governments to win elections when the economy is tanking, even if the cause of the recession has arisen offshore. A sitting government can claim credit for the bounce-back when it comes, if they have led a credible plan.

But the projections are bad – as they would be regardless of who’s in government. Crucially, unemployment is forecast to peak at 9.8% in September this year, right on time for the election.

So, is Robertson’s fiscal injection going where it’s most needed? New spending targets public health, housing and trades training, and the worst-affected industries and regions reliant on international tourism. But the opposition will attack Labour on its priorities.

Assuming that COVID-19 cases continue to decline, and without a deadly second wave, by the election public attention will have turned from disease control towards the genuine pain caused by unemployment, bankruptcies and reduced incomes.

Labour will need to maintain New Zealanders’ confidence that it is doing the best for economic recovery, especially in supporting businesses, while also keeping the virus out of the community. Among the electorate, however, there may be two schools of thought about the desirability of change to a centre-right government led by the National Party.

First, there is an old refrain in New Zealand that National is the party of sound economic management, while Labour is a spendthrift. This belief is not consistent with historical evidence. Principles of fiscal discipline[11] are now well embedded in New Zealand. Both major parties are now fiscally conservative, but not inflexibly so. For example, National prudently ran deficits to support recovery after the global financial crisis.

Read more: Beyond travel, a trans-Tasman bubble is an opportunity for Australia and NZ to reduce dependence on China[12]

But this is about political perception, not fiscal performance. National leader Simon Bridges was whistling the party chorus well before budget day. And in his post-budget speech he zeroed in on government borrowing amounting to $NZ80,000 per household, and the burden on future generations to repay it: “That’s equivalent to a second mortgage on every house.”

If such scepticism about Labour’s economic management prevails at the ballot-box, we could see a change of government.

Jacinda Ardern may be first-name-only popular overseas, but under New Zealand’s finely balanced proportional system she only just won a coalition majority at the previous election.

An alternative school of thought is that during economic recovery it’s unwise to dump a sitting government, provided they are doing basically the right things. Don’t change horses in mid-stream – especially when the stream is running rough. In late April, 87% of Kiwis approved[13] of the government’s response to the pandemic.

If “the team of five million” gets behind Labour’s economic recovery plan as it did for the disease-control plan, then Ardern could form another government after the election.

But a lot could go wrong in the meantime. Budget 2020 is just one risky step on a rocky political path ahead.

Stay in touch with The Conversation’s coverage from New Zealand experts by signing up for our weekly NZ newsletter[14] – delivered to you each Wednesday.

References

- ^ responding, recovering and rebuilding (www.beehive.govt.nz)

- ^ the most effective leader on the planet (www.theatlantic.com)

- ^ Well-being Budget (treasury.govt.nz)

- ^ rainy day budget (www.beehive.govt.nz)

- ^ scheduled (www.rnz.co.nz)

- ^ Past pandemics show how coronavirus budgets can drive faster economic recovery (theconversation.com)

- ^ only temporary (theconversation.com)

- ^ polling (www.stuff.co.nz)

- ^ leaked poll (www.rnz.co.nz)

- ^ Business confidence (www.interest.co.nz)

- ^ fiscal discipline (press-files.anu.edu.au)

- ^ Beyond travel, a trans-Tasman bubble is an opportunity for Australia and NZ to reduce dependence on China (theconversation.com)

- ^ 87% of Kiwis approved (static.colmarbrunton.co.nz)

- ^ weekly NZ newsletter (theconversation.com)

Authors: Grant Duncan, Associate Professor for the School of People, Environment and Planning, Massey University