Lachlan Murdoch and scores of other business chiefs want to put people before profits? Really?

- Written by Peter Fleming, Professor, University of Technology Sydney

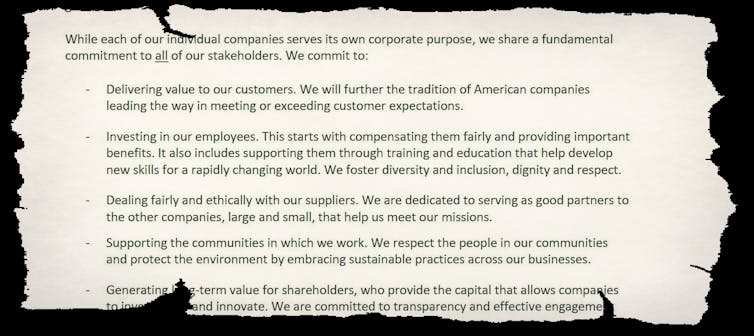

The legitimacy crisis facing corporate America must be starting to scare its affluent elite. The US Business Round Table has just published an open letter[1] arguing that it’s time for business to put people before profits.

Signed by chief executives of some of the world’s richest firms – including Amazon chief Jeff Bezos, Apple boss Tim Cook, and Fox’s executive chairman Lachlan Murdoch – the statement admits that in the past business leaders believed “corporations exist principally to serve their shareholders”.

But it says the times have changed. Corporations should now also focus on helping workers, the environment and other vulnerable “stakeholders”.

Since 1978, Business Roundtable has periodically issued Principles of Corporate Governance that include language on the purpose of a corporation. Each version of that document issued since 1997 has stated that corporations exist principally to serve their shareholders.

It has become clear that this language on corporate purpose does not accurately describe the ways in which we and our fellow CEOs endeavor every day to create value for all our stakeholders, whose long-term interests are inseparable.

Like many similar proclamations by the ultra-wealthy clique of American chief executives, the statement is meant to look as if capitalism is changing its ways.

Big business is no longer just about increasing shareholder value but “investing in our employees” as well as supporting communities, the environment, and suppliers.

Statement on the Purpose of a Corporation.

US Business Roundtable, August 2019[2]

Statement on the Purpose of a Corporation.

US Business Roundtable, August 2019[2]

When Tim Cook[3] speaks, people listen.

The New York Times[4] prominently featured news about the letter on its website, announcing a sea change in how America does business.

But looking through the platitudes about caring for “stakeholders”, an ulterior motive emerges.

Less than it seems

In the long wake of the 2008 global financial crisis, when working people carried the brunt of the US recession while Jeff Bezos increased his wealth by US$107 million every day[5], the business elite needs to periodically tell people that it really does care, that corporate capitalism is a force for good and not evil.

There are signs in the statement that point to its strategic nature.

For example, it says the tenets of neoliberalism and free markets are basically sound and do not require reform:

We believe the free-market system is the best means of generating good jobs, a strong and sustainable economy, innovation, a healthy environment and economic opportunity for all.

This is the free-market system that gave us the global financial crisis, income inequality on an unprecedented scale, unattainable house prices and, in Australia, wage growth that has stagnated for half a decade. Economies in the US and Europe are a mess, and Australia’s isn’t looking good.

The underlying sentiment in the statement is business-as-usual, plus “ethical fluff”.

And much is missing

What it doesn’t mention speaks volumes.

Nowhere does it broach the thorny issue of tax. Several of the signatories of the letter – including Larry Fink[6] from Blackrock – praised President Donald Trump’s corporate tax cuts. Their effect on inequality isn’t canvassed.

The elite often dismiss criticisms of corporate capitalism as pie-in-the-sky: tax is complex, we’re told. But don’t be fooled. A practical step would be a simple change in tax laws that makes Amazon[7] and Google[8] pay more than the minuscule percentage of revenue in tax that they current do.

Statements of “corporate social responsibility” – where oil firms, mining conglomerates and others pledge to do more for the environment or for workers or “stakeholders” – are often designed to ward off regulations that could limit their ability to make profits. They are often pre-emptory, designed to get in first.

Read more: One big problem with how Jeff and MacKenzie Bezos are spending a small share of their fortune[9]

They are like inoculations: business leaders get a tiny jab of the dose to immunise themselves against the real thing.

Or perhaps they mean it. We’ve yet to see signs.

References

- ^ open letter (opportunity.businessroundtable.org)

- ^ US Business Roundtable, August 2019 (opportunity.businessroundtable.org)

- ^ Tim Cook (www.apple.com)

- ^ New York Times (www.nytimes.com)

- ^ US$107 million every day (www.businessinsider.com.au)

- ^ Larry Fink (www.bbc.com)

- ^ Amazon (www.theguardian.com)

- ^ Google (www.abc.net.au)

- ^ One big problem with how Jeff and MacKenzie Bezos are spending a small share of their fortune (theconversation.com)

Authors: Peter Fleming, Professor, University of Technology Sydney