RBA starts three-year countdown to lift in interest rates

- Written by Isaac Gross, Lecturer in Economics, Monash University

In line with expectations, the Reserve Bank of Australia has announced it will keep official interest rates on hold at 0.10%.

But is also ready to start tapering off its “unconventional” monetary policy measures introduced in response to the COVID-19 economic crisis.

These measures, designed to stimulate spending by keeping interest rates low for the next few years, have had two key components,

1) The “Yield Curve Control program” — involving the bank buying government bonds to keep interest rates at 0.1% for the next three years.

2) Quantitative Easing – involving the RBA buying long-term government bonds to help keep interest rates low over the five to ten years, but without a fixed goal for interest rates.

These measures will be wound back slowly.

Following the Reserve Bank board’s July meeting, at which these decisions were made, governor Philip Lowe said [1]the Yield Curve Control program would end in April 2024 (the bank had been considering extending it to November 2024). The bond buying will continue but at a lower rate – at $4 billion a week rather than $5 billion.

A monetary policy dilemma

Heading into the meeting, the bank’s directors faced a dilemma. They knew the economy still required more support. Inflation remains below the target band. Unemployment is still too high. Lockdowns continue to periodically shutter large swathes of the economy.

Lowe has long promised the RBA won’t lift interest rates until inflation is back within its target band. He reiterated this today: “It will not increase the cash rate until actual inflation is sustainably within the 2-3% target range.”

It is not enough for inflation to be forecast in this range. The RBA wants to see results before it changes rates.

That still seems a long way off, with the central bank expecting the underlying inflation to be 1.5% over 2021, rising to 2% by mid-2023.

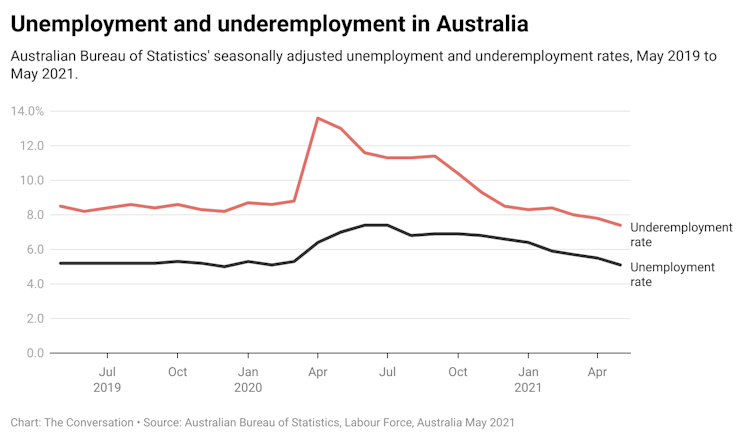

It maintains the key to getting wages and inflation higher is a stronger labour market. While unemployment is now at 5.1%, with underemployment also falling, that’s still a long way from “full employment”, which economists broadly agree is about 4.5-4.75%.

CC BY[2]

This starts the countdown to lift-off

Despite the still mediocre state of the economy, there has been rising concern the central bank’s stated commitment to keep interest rates at 0.1% until late 2024 would be risky if the economy continued to quickly improve as it has done over the past six months.

So the board’s solution to this dilemma is to wind back some of the unconventional monetary policy measures, in small bite-size chunks.

By doing this gradually, the RBA hopes to avoid a panic in the financial markets of the sort that occurred in the United States during the “Taper Tantrum” of 2013, when the US Federal Reserve announced it would start to wind back the quantitative easing programs first deployed in response to the Global Financial Crisis of 2007-08.

Today thus officially starts a three-year countdown to when we can expect interest rates to gradually lift off.

Steady as she goes

By continuing its quantitative easing program – albeit at the lower rate of buying A$4 billion of government bonds each week – the RBA will help keep long-term interest rates low.

This policy combination allows the bank to continue supporting the economy today with flexibility down the road to lift interest rates if and when appropriate.

If these optimistic forecasts do not pan out and the economy slows in the months ahead, the RBA has made it clear it will step back in with more support.

This dovish response will be good news for home owners and sellers. Low interest rates will likely see strong buyer demand continue.

Read more:

Vital Signs: It's not the Reserve Bank's job to worry about housing prices[3]

The RBA has said housing affordability is not an issue for it to resolve, but Lowe promised[4] it “will be monitoring trends in housing borrowing carefully and it is important that lending standards are maintained.”

CC BY[2]

This starts the countdown to lift-off

Despite the still mediocre state of the economy, there has been rising concern the central bank’s stated commitment to keep interest rates at 0.1% until late 2024 would be risky if the economy continued to quickly improve as it has done over the past six months.

So the board’s solution to this dilemma is to wind back some of the unconventional monetary policy measures, in small bite-size chunks.

By doing this gradually, the RBA hopes to avoid a panic in the financial markets of the sort that occurred in the United States during the “Taper Tantrum” of 2013, when the US Federal Reserve announced it would start to wind back the quantitative easing programs first deployed in response to the Global Financial Crisis of 2007-08.

Today thus officially starts a three-year countdown to when we can expect interest rates to gradually lift off.

Steady as she goes

By continuing its quantitative easing program – albeit at the lower rate of buying A$4 billion of government bonds each week – the RBA will help keep long-term interest rates low.

This policy combination allows the bank to continue supporting the economy today with flexibility down the road to lift interest rates if and when appropriate.

If these optimistic forecasts do not pan out and the economy slows in the months ahead, the RBA has made it clear it will step back in with more support.

This dovish response will be good news for home owners and sellers. Low interest rates will likely see strong buyer demand continue.

Read more:

Vital Signs: It's not the Reserve Bank's job to worry about housing prices[3]

The RBA has said housing affordability is not an issue for it to resolve, but Lowe promised[4] it “will be monitoring trends in housing borrowing carefully and it is important that lending standards are maintained.”

References

- ^ Philip Lowe said (www.rba.gov.au)

- ^ CC BY (creativecommons.org)

- ^ Vital Signs: It's not the Reserve Bank's job to worry about housing prices (theconversation.com)

- ^ Lowe promised (www.rba.gov.au)

Authors: Isaac Gross, Lecturer in Economics, Monash University

Read more https://theconversation.com/rba-starts-three-year-countdown-to-lift-in-interest-rates-163805