Walker reports record financial year

Walker Group Holdings has posted a record $675 million after tax profit for the June 2022 fiscal year.

The profit is a 226% increase on last year’s figures and revenue grew to $1.13 billion, coming from the Walker development and investments portfolio.

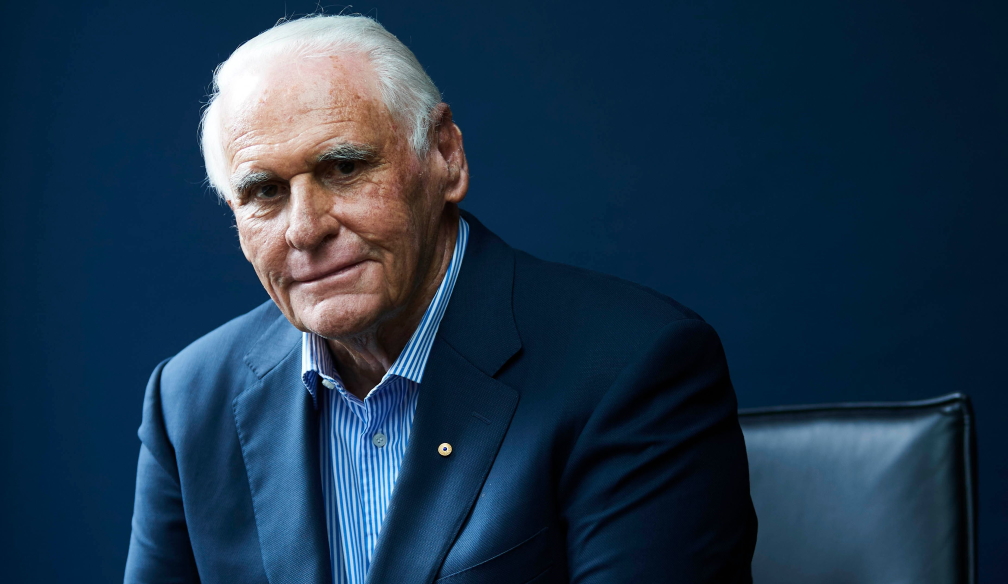

Founder and Executive Chairman Lang Walker AO said the business had successfully navigated many operating difficulties felt around the world.

“Our mindset has just been about putting our heads down and getting on with the job and our results are reflective of our strong teamwork during some of the toughest economic conditions in recent memory,” Mr Walker said.

“One of the major keys to achieving this result was having everyone working in the office together, enabling us to adapt to the changing conditions better than most.”

Walker has pushed through the current local and global difficulties to increase its total assets by 21% to $8.2 billion, with cash reserves of $394 million and the investment property portfolio increasing to $6.6 billion.

“Parramatta Square is complete and we have secured long term tenancies with major companies who have shifted their workforces out of the Sydney CBD and into our premium office towers,” Mr Walker said.

“We also benefitted from an impressive 12 months of over 1000 residential sales at Riverlea, South Australia’s biggest master-planned community.”

Walker is targeting a stronger year in 2023 with initial forecasts predicting more growth based on financial strength, a very strong team and first-class assets that are being delivered during the financial year.