Effi launches product search API to help brokers access data under new open banking system

- Written by a contributor

Mortgage broking fintech Effi has today announced it has developed and launched a new Product Search API on its platform, which will allow brokers to easily access product data on home loans provided by banks and lenders as required under the new open banking system.

The new feature means brokers will be able to instantly search a lending product and see key data points such as who is eligible for the product, what type of loan it is and more.

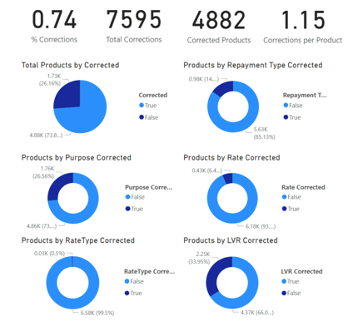

Screenshot of real data that can be retrieved from Effi’s product search API.

The first phase of Open Banking launched in July 2020 with major banks providing data, and as of July 1st 2021, remaining banks and financial institutions were required to share product data including Phase 3 products. The provided data is protected by the rules of the ACCC, but the ACCC has not been mandating the actual data entries and there are no enforceable regulations around the data to ensure it is up to date and correct.

To fill the gaps left by providers, Effi used significant business logic to fill out details and make the home loan product data available for over 100+ lenders via API in an easy-to-use format to anyone. What Effi initially found was:

- * Out of 114 lenders and 6,612 lending products in total, 1,700 products did not have a defined purpose, which is a critical part of the data i.e. home loan type

- * 4,882 products underwent at least one critical data point correction

- * 7,539 overall corrections were made for open banking products

The search API will boast the most up-to-date home loan product information, a comprehensive set of product details structured in a way that is beneficial for anyone building product comparison, and will allow mortgage brokers to compare and scan all products available through Open Banking to act in their consumers’ best interests. Moreover, any changes to the product rates and features from lenders will be instantly notified to the brokers so they can take the necessary steps to inform their existing clients or potential borrowers.

Mandeep Sodhi, Effi’s founder and CEO, said the launch of the API was an exciting innovation for the broker industry, but that it also highlighted the need for greater oversight on data provided by banks and lenders.

“It's great that we are now live with open banking, but it's becoming very clear that more still needs to be done for the system to be effective for its intended purpose. Two out of five products in the Consumer Data Right don’t have the basic information filled out - no right loan purpose, no loan rate type etc. This makes the data mining functionality very limited and creates concern for the level of trust we can place in the data that is actually provided.

“We’ve been working on this product search functionality since the launch of Phase 2 products last year by major ADIs. When open banking launched, we initially found searching through this data tedious and difficult - and we thought if we are struggling, why don’t we at least try and make it simpler for our brokers?

“Currently, the ACCC protects consumer data that is used in open banking, but there is no regulation from the other side. The idea with our search API is that lenders will overcome this and have an increased chance of getting their product in front of the customer with the correct and complete data,” said Mr Sodhi.

For further information on Effi’s platform, visit https://effi.com.au

About EffiEffi is passionate about making mortgage broking simple and intuitive. Founded by Mandeep Sodhi, the company’s mission is to help mortgage brokers become more Efficient in managing borrower relationships. Through its AI-powered fintech platform, Effi provides a complete end-to-end platform that offers lead engagement and management functionality, together with predictive analytics to help mortgage brokers improve their productivity and enterprises provide a seamless and sophisticated experience to their mortgage brokers.