The World Trade Organization is on life support. Will Trump’s new rules finish it off?

- Written by Jane Kelsey, Emeritus Professor of Law, University of Auckland, Waipapa Taumata Rau

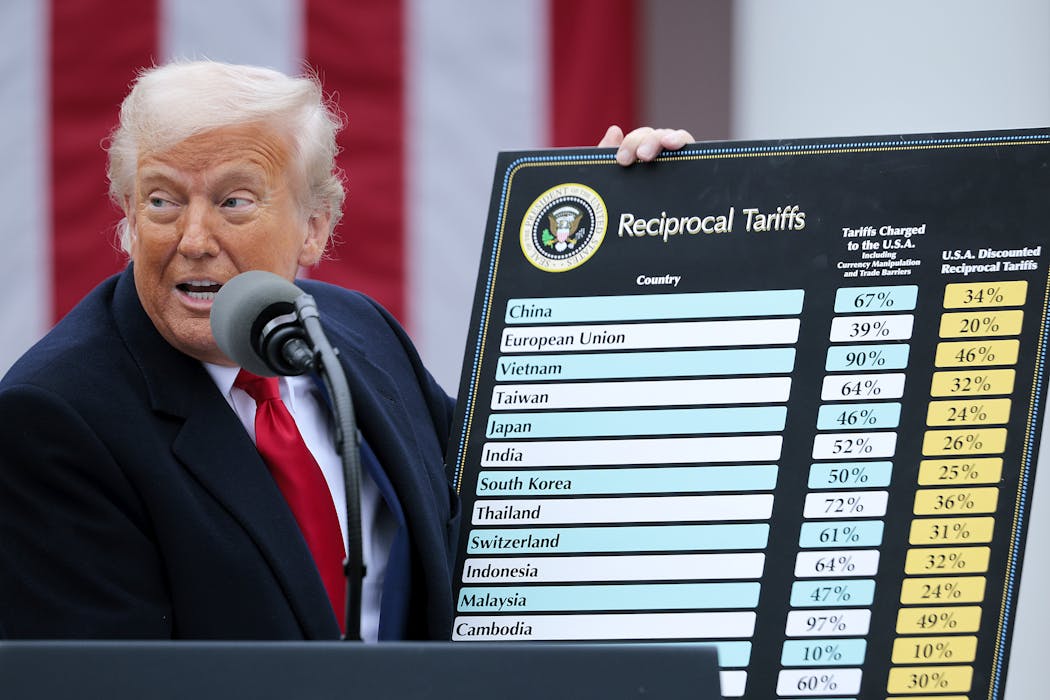

Chip Somodevilla/Getty Images

Chip Somodevilla/Getty ImagesThe United States has now withdrawn from 66 international organisations, conventions and treaties, illegally invaded Venezuela, and promoted an “America First” agenda in its new National Security Strategy.

This all signals the collapse of a global system that has operated for the past 60 years. The old...