KPay Secures Record USD55 Million, Marking 2024’s Largest Series A Fundraise Globally in the Payments Sector

KPay strengthens its position as the leading regional platform for merchants to simplify financial management and streamline business operations. The investment by Apis Growth Markets Fund III and Apis Global Growth Fund III will accelerate KPay’s trajectory to support one million merchants across Asia in the next five years

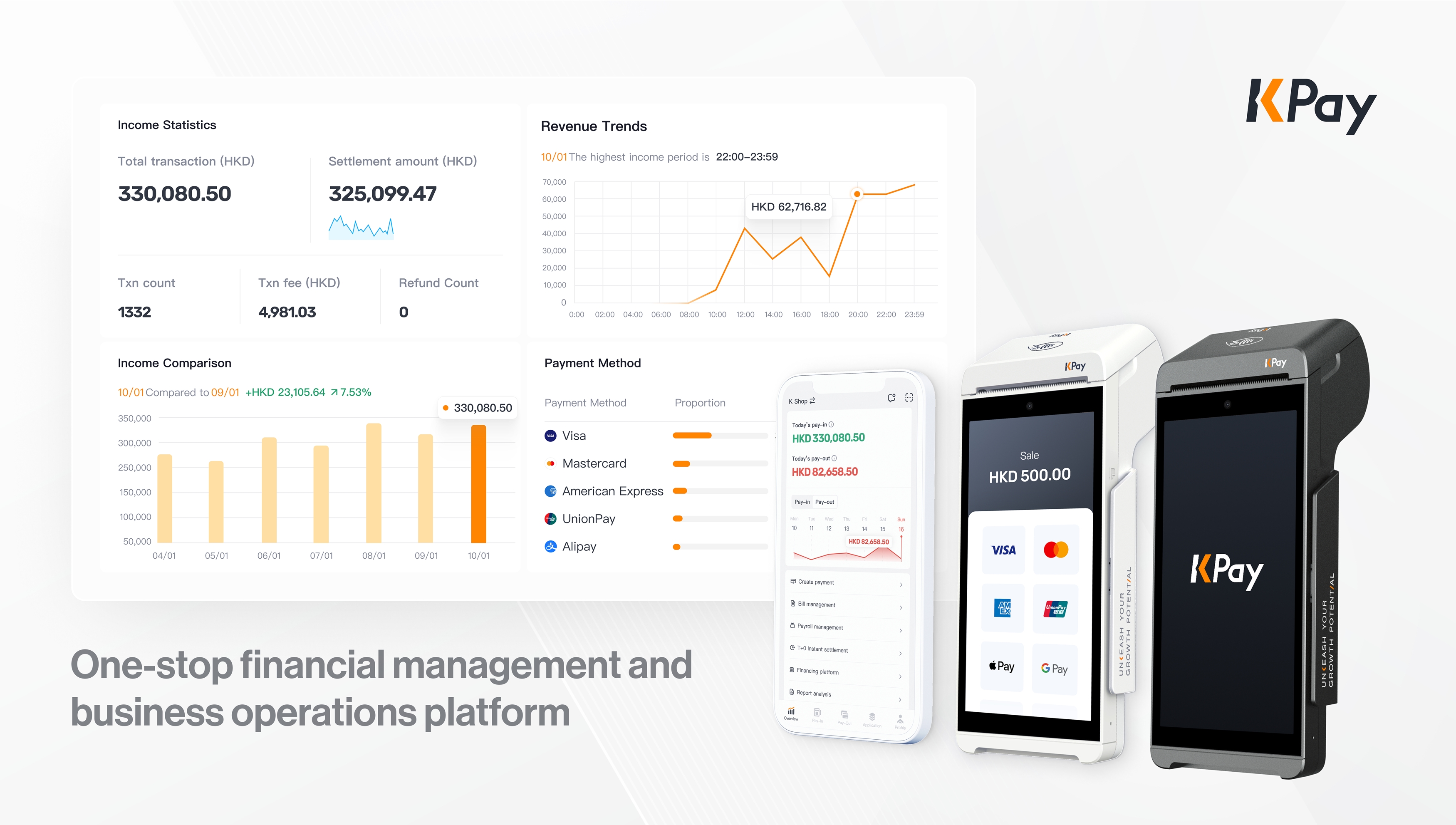

HONG KONG/SINGAPORE - Media OutReach Newswire - 3 December 2024 - KPay Group (KPay), a one-stop financial management and business operations platform, today announced the successful completion of its first institutional funding round, raising a record USD 55 million, the largest Series A globally in the payments sector in 2024[1].

This landmark investment was led by Apis Growth Markets Fund III and Apis Global Growth Fund III (both of which Apis Partners LLP serves as the portfolio manager for), validating KPay's strategic vision, market leadership and ambitious growth trajectory. UK-based Apis Partners is an ESG and Impact-native global private equity asset manager which manages or advises on total assets under management of USD 2.3 billion. This investment will not only accelerate KPay's existing trajectory but also provide the basis for its aggressive expansion plans across Emerging Asia.

With fintech funding in Asia Pacific hitting a six-year low[2] in H1 2024, KPay's record-breaking Series A stands out as a testament to the company's execution excellence and opportunity set ahead. The successful funding also demonstrates investors' appetite to back companies – like KPay - which have a proven playbook to drive expansion across Asia and can do so in a capital efficient manner. Notably, up until this Series A round, the company had yet to raise venture capital funding to deliver growth.

The investment from Apis Partners includes a commitment by KPay to expand its presence across key Asian economies, including Indonesia, the Philippines, Malaysia, Thailand, and more. KPay will leverage the capital to drive both organic growth and strategic mergers and acquisitions. This partnership aligns closely with the shared vision of Apis and KPay to drive meaningful change, recognizing the critical role of SMEs, which account for 55.8%[3] of total employment in Asia, and in turn acknowledges that supporting SME growth fosters broader economic development and strengthens regional economies.

Founded just over three years ago, KPay has achieved a remarkable 166% revenue CAGR during this period, operating across Hong Kong, Singapore and Japan. The company has built a one-stop solution to facilitate the financial, operational and digital transformation for merchants of all sizes, and is already serving more than 45,000 merchants in the region. With its open-architecture ecosystem, KPay currently partners with over 150 SaaS providers, banking institutions, and financial services firms and plans to double its partnerships to support even more businesses across Asia in their financial and digital transformation journey.

Davis Chan, Co-founder and CEO of KPay, says, "I am incredibly proud of this financial milestone our team has achieved. We are excited to use this funding to not only expand our existing markets' SME merchant base, but also broaden our reach into new merchant industry categories, merchants of all sizes, and merchants operating in other underserved markets across Asia. This will bring us closer to our ambitious goal of supporting one million merchants over the next five years"

Christopher Yu, President and CFO of KPay, adds, "Securing this funding gives us financial strength and flexibility to enhance our product innovation, go-to-market speed, customer experience, and operational excellence. All of this is with our merchants in mind, in making it even simpler, smarter, and more cost-effective for them when using KPay's services. To do this, we need to continue to attract the best partners and global talent to join us, who share the same ambition to work alongside us to achieve the company's vision and mission."

Matteo Stefanel, Co-Founder and Managing Partner at Apis Partners, comments: "We are thrilled to lead this investment in KPay, a unique company demonstrating remarkable growth under the leadership of seasoned third-time founders and an exemplary management team. As one of the most active global fintech investors in growth-stage companies, Apis is eager to bring our domain expertise to support this exciting phase of KPay's journey. With this combination of both financial strength and execution excellence, we look forward to a long-term partnership with KPay, to support their regional expansion, and spearheading next-gen financial management solutions in Asia's diverse payments and software sector."

Udayan Goyal, Co-Founder and Managing Partner at Apis Partners, adds: "As a financial services-focused investor, we recognise the unique value KPay brings to the market through its commitment to empowering merchants with accessible, impactful financial tools. This investment aligns perfectly with our ESG and Impact mandate to foster sustainable and inclusive growth within the financial sector, promoting the democratisation of finance, embedded finance and the deepening of the digital economy. We look forward to supporting KPay as it scales, helping the company deliver meaningful financial solutions across Asia."

Hashtag: #KPay #KConnect #KFund #SME #funding #fundraising #privateequity #payin #payout #finance #apispartners

The issuer is solely responsible for the content of this announcement.

About KPay Group

KPay Group ("KPay") is a leading fintech company dedicated to empowering businesses of all sizes with simple, smart, seamless and secure technology solutions. Serving over 45,000 merchants across Hong Kong, Singapore, and Japan, KPay is building a one-stop platform to support merchants in financial management, business operations and digital transformation across Asia, unlocking new growth potential for businesses. For the latest updates, follow us on LinkedIn or visit our website at www.kpay-group.com.

About Apis Partners

The Apis Group ("Apis") is an ESGI-native private equity and venture capital asset manager that supports growth-stage financial services and technology businesses globally by providing them with catalytic growth equity capital. Collectively Apis, through its team of around 40 professionals with deep industry expertise, manages or advises on total AUM of c.US$2.3 billion.

Headquartered in London, Apis has representation in seven countries globally. Apis is highly conscious of the impact that the provision of growth capital for financial services and technology businesses in global markets can achieve, and as such, financial inclusion and financial wellness are core tenets of Apis' impact investment approach. www.apis.pe