Trump is close to naming the new Federal Reserve chief. His choice could raise the risk of stagflation

- Written by Henry Maher, Lecturer in Politics, Department of Government and International Relations, University of Sydney

US President Donald Trump has signalled in an interview with the Wall Street Journal[1] he is close to announcing his pick for the next chair of the US Federal Reserve.

With inflation again increasing amid widespread focus on the crisis of affordability, Trump’s appointment will be closely watched by financial markets and consumers alike.

The central bank has become a battleground as Trump seeks to extend his influence over Federal Reserve policy.

But the last time a US president attempted to interfere with the independence of the Federal Reserve provides a strong cautionary tale of the dangers of presidential interference.

Trump’s tumultuous relationship with the Fed

Trump has a tumultuous relationship with the Federal Reserve and its current Chair Jerome Powell. Powell was first appointed chair by Trump in 2018, but the relationship quickly turned sour, with Trump repeatedly threatening to fire Powell for not cutting interest rates quickly enough.

Just last month, Trump[2] called Powell a “clown” with “some real mental problems”, adding “I’d love to fire his ass”.

Existing protections[3] mean Trump cannot fire Powell “without cause”, which the US Supreme Court has interpreted to mean corruption or misconduct. Trump has been forced then to wait for the end of Powell’s second term to replace him.

In the meantime, Trump has attempted[4] to fire Lisa Cook, one of the seven Fed governors, by having his Justice Department investigate claims of mortgage fraud against her. The charges however appear to be baseless[5], and Cook continues to serve as a Fed governor.

At the heart of the dispute with the Federal Reserve is Trump’s view that as president, he should be consulted on the setting of interest rates. With Americans facing a deepening affordability crisis, and Trump taking the blame, he is feeling the pressure to cut interest rates to boost growth.

Accordingly, Trump has insisted[6] that the next chair of the Fed must be someone who is prepared to immediately and significantly cut interest rates, and listen to Trump’s views on monetary policy going forward.

Central bank independence

Reduced interest rates might provide short-term juice to spur spending. However, in the long-term artificially low interest rates cause inflation[7], only worsening any cost-of-living crisis. For this reason, most developed countries maintain strictly independent central banks[8].

Central bank independence ensures short-term political considerations like elections and polling numbers do not interfere with long-term planning of monetary policy.

Back to the 70s?

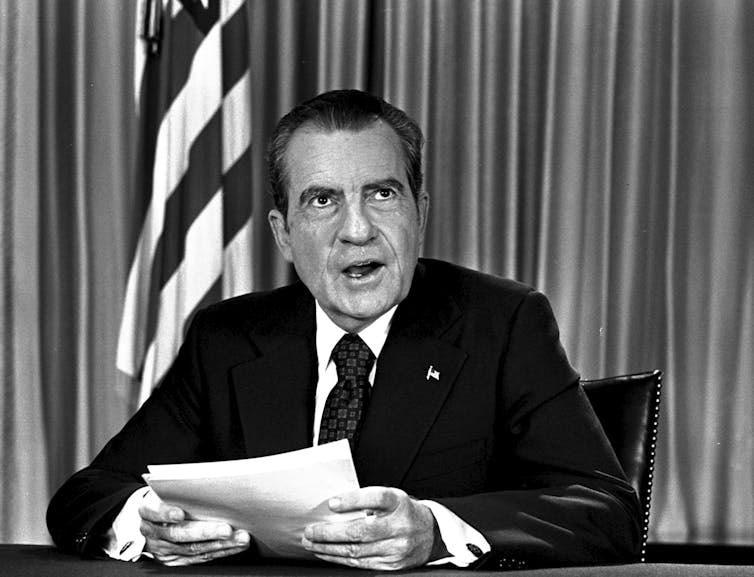

In 1970, during a growing inflation crisis, President Richard Nixon appointed economist Arthur Burns as chairman of the Federal Reserve. Like Trump, Nixon demanded that Burns reduce interest rates and listen to the president’s advice in crafting monetary policy. At Burns’ swearing in, Nixon said he would meet with Burns regularly, adding[9]:

You see, Dr Burns, that is a standing vote of appreciation in advance for lower interest rates and more money […] I respect his independence. However, I hope that independently he will conclude that my views are the ones that should be followed.

Under pressure from the president, who threatened[10] to pass legislation diluting Fed independence if Burns did not comply, Burns repeatedly cut interest rates. However, prematurely low interest rates and the perception that the president was influencing monetary policy only deepened the economic crisis facing the US in the 1970s.

The result was stagflation[11], the dismal economic situation in which both inflation and unemployment increase simultaneously. Under Burns’ watch, annual inflation peaked at 11% and unemployment at 8.5%.

A protest march in 1970s New York against surging inflation.

H. Armstrong Roberts/Getty[12]

A protest march in 1970s New York against surging inflation.

H. Armstrong Roberts/Getty[12]

The “Great Inflation” of the 1970s was eventually ended by another Fed chief, Paul Volcker. Recognising that Burns had created a spiral of inflationary expectations, in 1980 Volcker drastically increased interest rates to 19%. Volcker then kept interest rates in double digits until inflation permanently fell.

The so-called “Volcker shock[13]” did eventually tame inflation, but at the cost of cripplingly high interest rates and surging unemployment.

The Great Inflation of the 1970s, and the price paid to end it, stands as a strong warning against the short-term sugar hit of reducing interest rates in response to political pressure.

Will Trump learn the lessons of history?

With some economists warning[14] signs of stagflation are once more emerging, Trump must now pick the next chair of the Federal Reserve.

Prediction markets suggest[15] the most likely candidate is Kevin Hassett, an economist appointed last year by Trump as director of the National Economic Council.

Like Trump, Hassett believes interest rates should be much lower. Having served in both Trump administrations, Hassett also appears likely to offer loyalty and compliance with Trump’s demands.

The second candidate under consideration by Trump is economist Kevin Warsh, a former Fed governor and bank executive. Warsh brings a reputation as an inflation hawk from his time at Federal Reserve during the Global Financial Crisis.

However, a recent interview[16] with the president appears to have assured Trump that Warsh shares his goals, and he is now “at the top of the list” of candidates.

Regardless of who Trump appoints, the crucial question remains whether the next Fed chair will pursue an independent monetary policy free from political interference.

With the president continuing to concentrate power[17] in the hands of the executive, the Federal Reserve remains an important site for the exercise of independent power.

The stagflation crisis of the 1970s stands as a clear warning of what might happen if that independence is compromised.

The spectre of stagflation means financial markets, consumers, and the rest of the world remain unwilling participants in the political drama continuing to play out between the Federal Reserve and the White House.

References

- ^ Wall Street Journal (www.afr.com)

- ^ Trump (www.youtube.com)

- ^ Existing protections (theconversation.com)

- ^ attempted (www.abc.net.au)

- ^ baseless (www.reuters.com)

- ^ insisted (www.cnbc.com)

- ^ rates cause inflation (www.imf.org)

- ^ independent central banks (www.imf.org)

- ^ adding (www.presidency.ucsb.edu)

- ^ threatened (www.aeaweb.org)

- ^ stagflation (www.barrons.com)

- ^ H. Armstrong Roberts/Getty (www.gettyimages.com.au)

- ^ Volcker shock (www.sciencedirect.com)

- ^ warning (www.forbes.com)

- ^ suggest (www.barrons.com)

- ^ recent interview (www.cnbc.com)

- ^ concentrate power (carnegieendowment.org)

Authors: Henry Maher, Lecturer in Politics, Department of Government and International Relations, University of Sydney