Effi announces new partnership with global comparison site Finty

- Written by Media & Capital Partners

AI-powered, broker-oriented fintech Effi has formed a partnership with comparison website Finty to help match consumers looking for a loan with mortgage brokers.

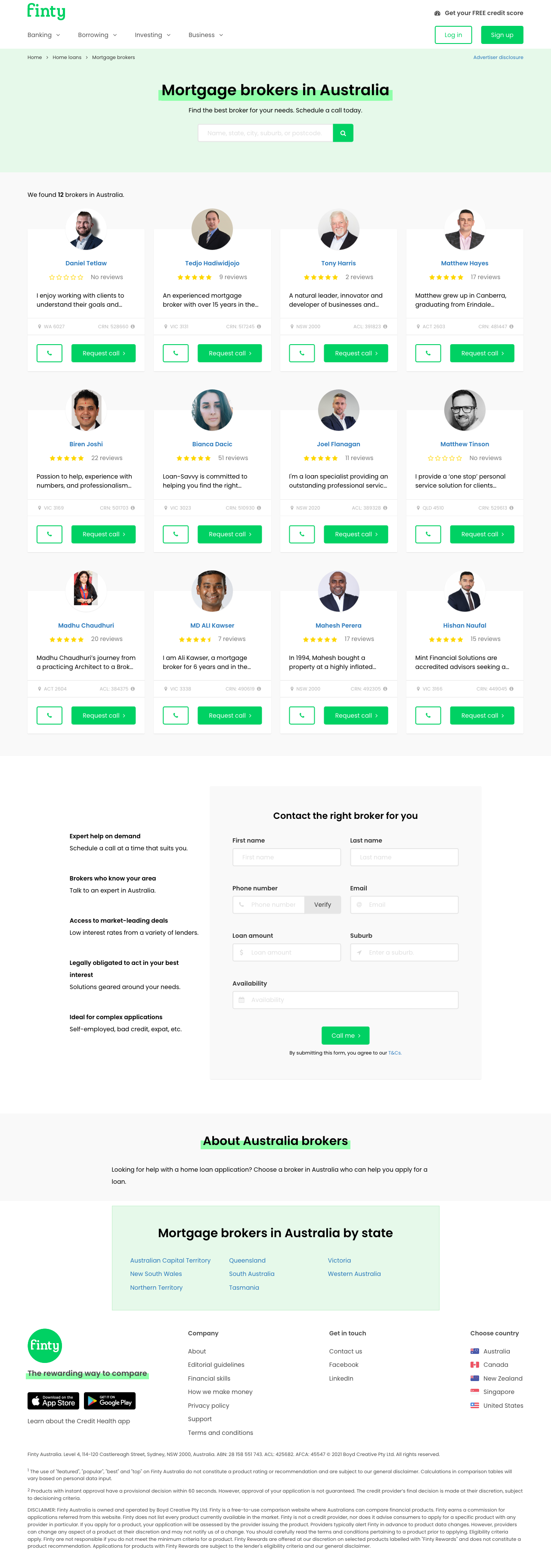

Mortgage broking platform Effi has announced a partnership with comparison site Finty, which will enable brokers to reach more potential customers throughout Australia.

Finty, formerly Credit Card Compare, is on a mission to make comparing complex financial products easier and more rewarding. Over 33,000 Australians have signed up to the globally established comparison website.

Effi and Finty’s unique partnership will allow brokers to build a brand profile on the Finty website and position themselves as a trusted broker, in front of thousands of Australians.

The partnership will also allow consumers to use the Finty platform to book an appointment with brokers through Effi’s Calendar Sync using a verified phone number. There is no setup fee for the Finty profile, a broker profile is simply featured within seconds of purchasing appointments from the Effi platform.

For brokers using the Effi platform, there is no obligation to purchase ongoing leads or spend commitment. Effi’s Instant Call feature allows borrowers to speak to their selected broker instantly from the Finty website.

Mandeep Sodhi, CEO of Effi, said Finty recognised the benefits of partnering with the broking platform because of how unique Effi’s technology is to Australian brokers.

“We take pride in knowing our platform offering is beneficial to Australian brokers, and Finty recognised this too,” said Sodhi.

“We’ve built this unique marketplace solution that can be white-labeled by comparison websites and high traffic websites that want to show mortgage brokers without having to go through the hassle of building the whole infrastructure and onboard each individual broker.

“Effi solves this through its marketplace solution that's easily deployable and configurable.

“The partnership will see the thirty-thousand customers that use the Finty platform find brokers with ease. In turn, brokers that use the Effi platform will be able to position themselves as a trusted broker.

“Since offering brokers a profile on Finty, Effi users have received a significant increase in traffic and reported double-digit conversion rates from lead to loan settlement - far above the industry standard.”

Finty’s co-CEOs Andrew and David said partnering with Effi’s sophisticated mortgage broker platform was an obvious choice for them.

“We’re excited to be working with Effi to build out the home loan section of our comparison platform.”

“Shopping for home loans and going directly to a lender isn’t the preferred route for all home buyers since well over half of all home loans in Australia are settled by mortgage brokers.”

“What’s so good about the Effi platform is that we can digitally connect our home loan comparison shoppers on Finty to a growing number of highly-rated local mortgage brokers. From that stage in this integrated process, we know our Finty members and visitors will be given the personalised service and expert advice they need to secure a mortgage from a wide range of lenders, including the major banks.”

The partnership comes shortly after Effi launched its product search API tool that enables brokers to sift through the incomplete data points of the open banking system.

Effi will continue to improve and update its platform, striving to address some of the most common issues plaguing the mortgage broking process.

For further information on Effi’s platform, visit https://effi.com.au.