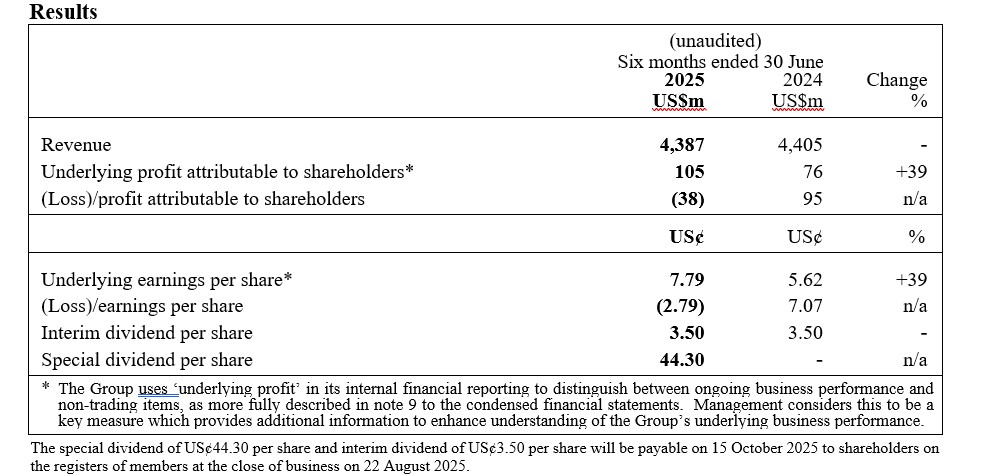

DFI Retail Group Holdings Limited Half-Year Results For The Six Months Ended 30 June 2025 And Announcement Of Special Dividend

- 39% underlying earnings growth

- Increased contributions from associates, Health & Beauty and Food

- Health & Beauty delivered strong like-for-like (LFL) sales growth of 4%

- Portfolio simplification continues with the announced divestment of Singapore Food business and sale of minority stake in Robinsons Retail

- Proceeds from Yonghui and Robinsons Retail divestments strengthen balance sheet to a net cash position of US$442 million

- Raised full-year underlying profit guidance to be between US$250 million and US$270 million

- Declared special dividend of US¢44.30 per share in addition to interim dividend of US¢3.50

Our ongoing portfolio evolution enables us to prioritise capital on high-margin businesses and growth initiatives, while providing strategic flexibility for inorganic opportunities. As a result of our strategic progress, we are pleased to announce a special dividend of US¢44.30 per share – the first in 18 years – returning a total of US$647 million to shareholders, including the regular interim dividend. These decisions underscore our confidence in DFI's long-term growth strategy and commitment to shareholder returns."

Scott Price

Group Chief Executive

OVERVIEW

The Group continued to demonstrate strong business resilience by effectively executing its strategic and margin expansion initiatives. Despite the continued shift towards value by consumers, LFL subsidiary sales for the first half of 2025 remained largely stable compared to the same period last year, excluding the impact of a significant cigarette tax increase in Hong Kong and the divestment of Hero Supermarket business in Indonesia in 2024. LFL subsidiary sales have demonstrated a steady recovery with a return to moderate growth in the second quarter of 2025.

Significant progress has been made in the Group's strategic pivot from a portfolio investor to an operating company centred on five key deliverables:

- Retail excellence: Delivering a best-in-class customer proposition

- Customer access: Strategically expanding store network

- Omnichannel and data ecosystem: Powering e-commerce and retail media with data-driven insights

- Lean and agile operations: Streamlining business for more efficient decision making

- Evolving portfolio: Prioritising capital returns and shareholder value

The Group continues to evolve its portfolio to enhance operational focus and enable more efficient capital allocation, supporting subsidiary business growth both organically and inorganically should shareholder accretive opportunities arise. During the reporting period, the Group completed the divestment of minority stakes in both Yonghui and Robinsons Retail, generating total gross proceeds of approximately US$900 million. Additionally, the Group announced the divestment of its Singapore Food business for approximately US$93 million in cash consideration.

As a result of this strategic progress, the Board has approved a special dividend of US¢44.30 per share, equivalent to US$600 million in total payment. Concurrently, the Group declared an interim dividend of US¢3.50 per share, in line with the prior comparable period. These decisions underscore the Group's confidence in its long-term growth strategy and its commitment to creating value for its shareholders.

OPERATING PERFORMANCE

Overall

Total revenue from subsidiaries for the first half of 2025 was US$4.4 billion, up 0.3% year-on-year on a LFL basis, excluding the impact of a significant cigarette tax increase in Hong Kong and the divestment of the Hero Supermarket business in Indonesia in 2024. Strong sales growth in the Health & Beauty division was offset by lower contributions from other segments. Total revenue, which includes 100% of associates and joint ventures, was US$8.2 billion. Excluding the impact of the minority stake divestment in Yonghui completed at the end of February 2025, as well as the additional two months of sales contribution from Robinsons Retail following the stake disposal at the end of May 2025, total revenue increased by approximately 1%.

Total underlying profit attributable to shareholders for the first half of 2025 reached US$105 million, representing a year-on-year increase of 39%, primarily driven by improved performance in associates. Underlying profit from subsidiaries was US$75 million, reflecting a 3% year-on-year increase. Strong performance in the Health & Beauty and Food divisions was partially offset by lower profitability in Convenience as a result of the cigarette tax impact, and higher selling, general and administrative expenses[1] primarily due to a one-time reversal of long-term incentive accruals in 2024 related to executive departures. After accounting for the divestment of Yonghui, underlying profit from associates was US$30 million, an improvement from US$3 million from the prior comparable period, supported by higher contributions from both Maxim's and Robinsons Retail.

Free cash flow for the period was a net inflow of US$89 million, compared with US$61 million in the first half of 2024. As at 30 June 2025, the Group's net cash was US$442 million, compared to US$468 million net debt at 31 December 2024.

Subsidiaries

Sales for the Health & Beauty division were US$1.3 billion, up 4% year-on-year on a LFL basis, underscoring the strengthening brand equity of Mannings and Guardian as trusted advisors in health and wellness. Mannings Hong Kong delivered strong LFL sales growth of 6%, driven by growing basket size as the team continued to enhance assortment in key wellness categories, including supplements and derma skin care. Solid LFL sales performance of Guardian was supported by basket size increases across key Southeast Asian markets and improved promotional efficiency, particularly in Indonesia. Integrating the Own Brand team across Food and Health & Beauty drove stronger product relevance and cost efficiency, resulting in improved sales and profit productivity per SKU. Overall, divisional profit grew 8% to US$109 million on a LFL basis1.

Total Convenience sales were US$1.1 billion, down 4% year-on-year on a LFL basis, primarily due to reduced volumes of lower-margin cigarette following tax increases in Hong Kong at the end of February 2024. Excluding cigarettes, overall LFL sales were down 1%. Hong Kong performance recovered in the second quarter, following the annualisation of the tax effect and continued growth in higher-margin ready-to-eat (RTE) categories. Excluding cigarettes, LFL sales for the first half were in line with the prior comparable period. 7-Eleven Singapore reported LFL sales below the same period last year. South China reported robust sales growth due to network expansion but lower LFL sales given intensified subsidy initiatives from food delivery platforms. The team remains focused on driving footfall and sales by expanding the RTE offering, including a larger rollout of the Food Bar format to 375 stores by the end of this year. Despite a favourable sales mix shift towards higher-margin RTE products, profit for the division dropped by 18% year-on-year to US$38 million due to tough comparables in the first half of 2024 as a result of a one-off windfall gain from cigarette inventory purchased before tax increase. Excluding which, profit for the division was up 9% year-on-year.

Revenue for the Food division reduced marginally to US$1.5 billion, after excluding the impact of the divestment of the Hero Supermarket business last year. Sales resumed growth in the second quarter, supported by the Group's focus on enhancing the value of consumers' food baskets. In Hong Kong, investment in reduced pricing has resulted in a 2.5% increase in footfall in May and 3.4% in June, in addition to a consistent rise in items per basket. To further enhance its fresh and value proposition, the Wellcome team launched a partnership with Dingdong Limited (DDL), a leading Chinese online grocery platform, during the second quarter of 2025. The collaboration offers consumers a wider selection of fresh produce at more competitive prices. The team's effort to strategically source the core basket will support both price reinvestment and continued net margin expansion in the coming years. Overall Food profit grew 14% year-on-year to US$24 million on a LFL basis1.

Sales performance of the Home Furnishings division remained challenged due to intense competition and shifts in basket mix, mainly in Hong Kong and Indonesia while Taiwan demonstrated relative resilience. Effective cost control measures across markets supported a recovery in underlying profit for the first half of the year. The IKEA Hong Kong business is strengthening its value-driven omnichannel proposition by reinvesting in core product pricing, evolving seasonal food range and leveraging yuu data for more precise customer targeting. In Indonesia, the IKEA team remains focused on driving sales through an expanded digital presence and intensified marketing efforts.

Digital

During the first half of 2025, the Group continued to strengthen its digital presence with the launch of new online channels, including a 7-Eleven app in Singapore. Our expanded digital assets, quick commerce service with third-party platforms and data-driven personalised offerings create a seamless omnichannel shopping experience across physical and digital touchpoints, contributing to a growing e-commerce penetration of approximately 5%. Daily e-commerce order volume surpassed 96,000, reflecting an 85% year-on-year increase and a substantial improvement in profit contribution.

DFIQ, the Group's retail media business, continues to gain strong momentum, completing over 160 targeted marketing campaigns in the first half of 2025, compared to 12 in the prior comparable period. The DFIQ team has successfully piloted in-store media in select Mannings stores in Hong Kong, as well as Guardian and 7-Eleven outlets in Singapore. This uniquely integrated online-to-offline retail media solution provides suppliers with an expanded reach, driving enhanced customer loyalty and conversion throughout the entire purchase journey.

Associates

The Group's share of Maxim's underlying profits was US$14 million for the first half of 2025, up from US$8 million in the same period last year, underpinned by continued cost optimisation and operational efficiency measures. Sales performance was largely stable year-on-year, with strong growth in Southeast Asia offset by weaker restaurant performance in Hong Kong and the Chinese mainland.

Underlying profit contribution from Robinsons Retail was US$18 million, an improvement of approximately US$9 million from the first half of 2024. This includes the impact of two additional months of contribution, amounting to approximately US$5 million, following the completion of the divestment at the end of May 2025.

The divestment of the Group's stake in Yonghui was completed in February 2025.

RECENT BUSINESS DEVELOPMENTS

On 24 March 2025, the Group announced that it had entered into a definitive agreement with Macrovalue, a leading Southeast Asian retail group, with respect to the divestment of its Singapore Food business, which includes the Cold Storage, CS Fresh, Jason's Deli and Giant brands, for a total cash consideration of SGD125 million or approximately US$93 million, subject to adjustments. The transaction is subject to closing conditions and is expected to be completed by the end of 2025.

On 30 May 2025, the Group announced and completed the divestment of its 22.2% stake, in Robinsons Retail Holdings, Inc., for a total cash consideration of PHP15.8 billion or approximately US$283 million. Following the completion of the transaction, the Group ceases to hold any interest in Robinsons Retail.

The above transactions reflect the Group's strategic pivot from a portfolio investor to a focused operating company, enabling the Group to redeploy capital to support the growth of its subsidiary businesses with higher accretive returns.

OUTLOOK

The Group remains confident in its ability to navigate the evolving market landscape, supported by strategic initiatives aimed at driving market share gain and profit growth across all businesses. These initiatives include strengthening the value proposition, optimising assortment through data-driven insights, expanding omnichannel presence and accelerating monetisation of digital assets. With a more focused business portfolio and enhanced operational efficiency, the Group is committed to delivering sustained, profitable growth by balancing ongoing investments in businesses and areas with long-term strategic value, while also increasing returns for shareholders.

The Group restates its full-year organic revenue growth outlook to a range of 0.5% to 1.0% (from approximately 2%), reflecting broader economic uncertainty and a sharper-than-expected decline in cigarette sales. Despite a more cautious revenue outlook, the Group expects to deliver stronger profitability through enhanced operational efficiency and disciplined cost management. The Group, therefore, revises its full-year guidance of underlying profit attributable to shareholders to be between US$250 million and US$270 million (up from previously between US$230 million and US$270 million).

Scott Price

Group Chief Executive

Hashtag: #DFIRetailGroup#Guardian#Mannings#7-Eleven#ColdStorage#Giant#Wellcome#IKEA#yuu#Maxim's

The issuer is solely responsible for the content of this announcement.

DFI Retail Group

DFI Retail Group (the Group) is a leading Asian retailer, driven by its purpose to ‘Sustainably Serve Asia for Generations with Everyday Moments’.

At 30 June 2025, the Group and its associates operated over 7,500 outlets, of which over 5,500 stores were operated by subsidiaries. The Group, together with its associates, employed over 83,000 people, with over 45,000 employed by subsidiaries. The Group had total annual revenue in 2024 of US$24.9 billion and reported revenue of US$8.9 billion.

DFI is dedicated to delivering quality, value and service to Asian consumers through a compelling retail experience supported by an extensive store network and highly efficient supply chains.

The Group including its associates operates a portfolio of well-known brands across five key divisions: health and beauty, convenience, food, home furnishings and restaurants. The principal brands are:

Health and Beauty

• Mannings on the Chinese mainland, Hong Kong and Macau S.A.R.; Guardian in Brunei, Indonesia, Malaysia, Singapore and Vietnam.

Convenience

• 7-Eleven in Hong Kong and Macau S.A.R., Singapore and Southern China.

Food

• Wellcome and Market Place in Hong Kong S.A.R.; Cold Storage and Giant in Singapore; Lucky in Cambodia.

Home Furnishings

• IKEA in Hong Kong and Macau S.A.R., Indonesia and Taiwan.

Restaurants

• Hong Kong Maxim’s group on the Chinese mainland, Hong Kong and Macau S.A.R., Cambodia, Laos, Malaysia, Singapore, Thailand and Vietnam.

The Group’s parent company, DFI Retail Group Holdings Limited, is incorporated in Bermuda and has a primary listing in the equity shares (transition) category of the London Stock Exchange, with secondary listings in Bermuda and Singapore. The Group’s businesses are managed from Hong Kong. DFI Retail Group is a member of the Jardine Matheson group.