Coface Asia Corporate Payment Survey 2024: Overall improvement but worsening payment behaviour in textile and construction

HONG KONG SAR - Media OutReach Newswire - 5 June 2024 - The Asia Corporate Payment Survey, conducted by Coface between December 2023 and March 2024, provides insights into the evolution of payment behaviour and credit management practices of about 2,400 companies across the Asia Pacific region.

Respondents are active in nine markets (Australia, China, Hong Kong SAR, India, Japan, Malaysia, Singapore, Taiwan and Thailand) and 13 sectors.- Overall, credit conditions are tightening, with payment terms decreasing to 64 days from 66 in 2022. In the meantime, the duration of payment delays decreased from 67 to 65 days

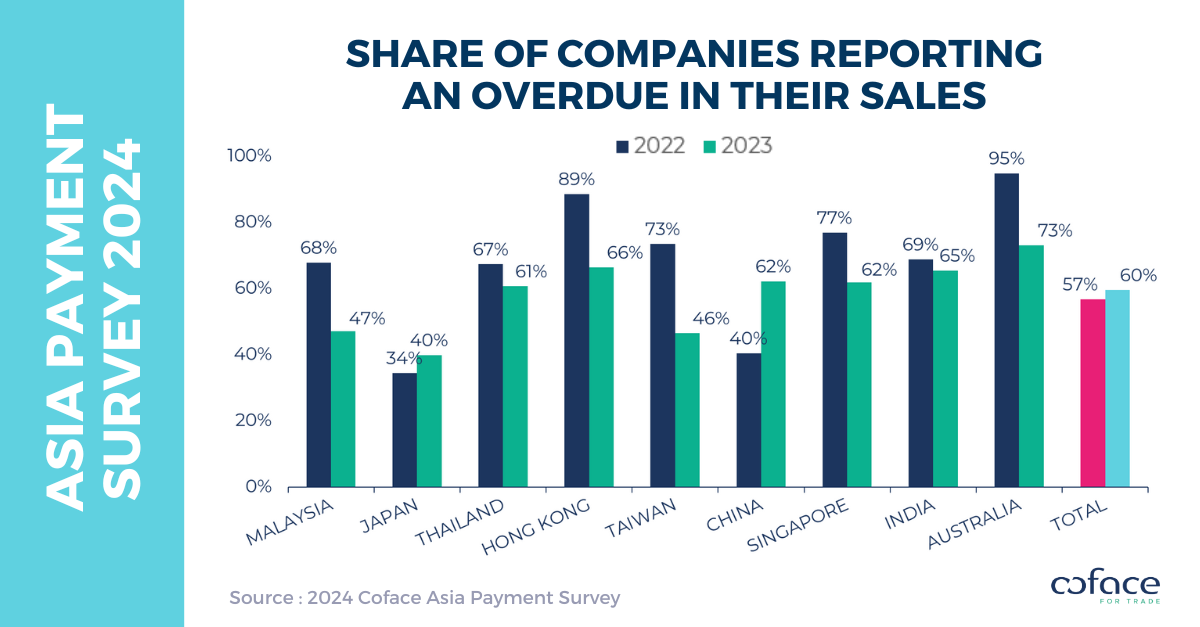

- Late payments were more frequent, with 60% of companies experiencing them compared with 57% in 2022, but their average duration fell from 67 to 65 days. Ultra-long payment delays have increased. Textiles and construction are the most affected sectors by these delays.

- 56% of companies expect the economic outlook to improve in 2024, although slowing demand and intense competition are major risks.

'The year 2023 was one of normalisation from the pandemic, but the economic landscape continued to offer its share of challenges in the form of an elevated inflationary and interest rate environment amid persistent geopolitical risks. The surveyed companies expressed the same concerns with about half of respondents citing slowing demand and over-competitive pressures as the two main risks to their company's operations in 2024. Coface forecasts economic growth in Asia Pacific to maintain at over 4% in 2024, with the region still the fastest growing in the world.' said Bernard Aw, Chief Economist for Asia-Pacific at Coface.

Payment delays: Significant late payment rise in textile and construction

The share of companies surveyed reporting payment delays rose from 57% in 2022 to 60% in 2023, with only China and Japan driving the rise, largely due to their tighter payment terms. Meanwhile, all other markets covered witnessed a reduction in payment delays reported, suggesting improved financial stability after the pandemic. Excessive competition, slowing demand, slowdown in cash flow, and customers' payment defaults are the main cited reasons for payment delays in the region.

Textile and Construction saw a significant increase in late payments reported. Textile faced higher production costs and rampant demand, and Construction suffered sluggish China property sector and a high interest rates environment in most markets.

While the average payment delay duration dropped from 67 days in 2022 to 65 days in 2023, most markets covered saw a rise. Australia, Hong Kong and Malaysia saw the highest increase, while only China, Taiwan and Thailand saw a decline. Japan had the shortest average payment delay at 50 days, and Australia had the highest at 83 days.

The duration of payment delays increased the most in the textile and agri-food sectors, both by 11 days. Energy and pharmaceuticals saw the biggest falls, of 11 and 10 days respectively. The construction sector still has the longest payment delay (76 days), and the pharmaceutical has become the one with the shortest (57 days).

The proportion of respondents experiencing ultra-long payment delays (ULPD) over 2% of their annual sales has risen from 26% in 2022 to 29% in 2023. This 2% threshold represents a very high risk of non-payment, given that 80% of these delays have never been paid, according to Coface's experience. Singapore, Thailand, and Hong Kong lead the increase in the proportion of ULPDs. Textile is the sector with the highest share of respondents reporting ULPDs, with an increase from 14% in 2022 to 40% in 2023, while Construction and Metals both stand at a substantial 35%.

Companies are generally optimistic about future payment behaviours, with 30% expecting improvement in late payment trends while the 18% expecting deterioration are mainly textile and retail companies.

Economic Expectations: Growing optimism despite demand risks

Asia Pacific (APAC) saw an improvement in economic conditions in 2023, thanks to the reopening of China's borders and its abandonment of zero-covid policies, as well as lower inflation and a slower rate of restriction of monetary policies globally. Consequently, almost half of our respondents (49%) signaled improved business activity compared to 2022, while only 20% signaled a deterioration.

Looking forward, we forecast economic growth in APAC to maintain at over 4% in 2024. This is consistent with our respondents' anticipations, as 56% expect their business activity to improve in 2024 with India and Thailand the most optimistic economies. Sector-wise, Retail, and textile had the highest share of respondents anticipating a worsening of business activity, while confidence in the year's business activity was the greatest for wood, automotive, pharmaceutical, and agrifood.

Companies still reported several risks that could hurt their operations in 2024. Nearly half of respondents cited slowing demand and over-competitive pressures, and nearly a third highlighted higher prices for inputs and raw materials and higher labour costs as a key operational risk.

Hashtag: #Coface

https://www.linkedin.com/company/coface

The issuer is solely responsible for the content of this announcement.

COFACE: FOR TRADE

With over 75 years of experience and the most extensive international network, Coface is a leader in trade credit insurance & risk management, and a recognized provider of Factoring, Debt Collection, Single Risk insurance, Bonding, and Information Services. Coface's experts work to the beat of the global economy, helping ~50,000 clients in 100 countries build successful, growing, and dynamic businesses. With Coface's insight and advice, these companies can make informed decisions. The Group' solutions strengthen their ability to sell by providing them with reliable information on their commercial partners and protecting them against non-payment risks, both domestically and for export. In 2022, Coface employed ~4,720 people and registered a turnover of €1.81 billion.

For more information, visit coface.com.hk