Residential and CRE Investments in GBA Gain Traction

New economy assets such as industrial, logistics and data centres on the rise

Transactions In 1H 2022 Amounted to RMB24 Billion, 5-Year Record High by Investment Share in Greater China

- In 1H 2022, the overall sales figure for the primary and secondary residential market demonstrated a year-on-year downturn. Nevertheless, the majority of the transactions were premium and luxury properties, pushing the overall house price benchmark upwards. The total sales figure for the year is expected to rise by 5% to 10%.

- The CRE investment market in the Greater Bay Area (GBA) recorded a total transaction value of RMB24 billion, accounting for about 32% of the total large size deals (>100M RMB) in China, hitting a five-year record high by investment share.

- Investment in new economy assets such as industrial, logistics, and data centres has increased significantly and started to dominate the market. In particular, transactions of industrial logistics in Shenzhen made up 73% of the GBA market, a six-fold rise on the same period last year.

- Investment transaction activity in 1H 2022 was dominated by domestic investors at RMB22.2 billion, demonstrating optimism in investment appetite.

HONG KONG SAR - Media OutReach - 28 July 2022 - Global real estate services firm Cushman & Wakefield today published its Greater Bay Area Property Investment Market Review and Outlook 1H 2022. In 1H 2022, the residential market in the Greater Bay Area (GBA) demonstrated a price increase, but coupled with a fall in the number of transactions. The overall sales figure has dropped by around 45% y-o-y, yet the price has shown a general upward trend. With the development of GBA cities becoming more mature and as the transportation network completes, demand in logistics from Guangzhou, Shenzhen and Dongguan have expanded to other GBA cities, resulting in increased investment activities in new economy assets such as industrial, logistics, industrial parks, and data centers. However, due to the continued impact of the pandemic on corporate development and retail consumption, investors have become more cautious about conventional offices and shopping centres, while self-use-driven purposes covered 90% of the total investment share.

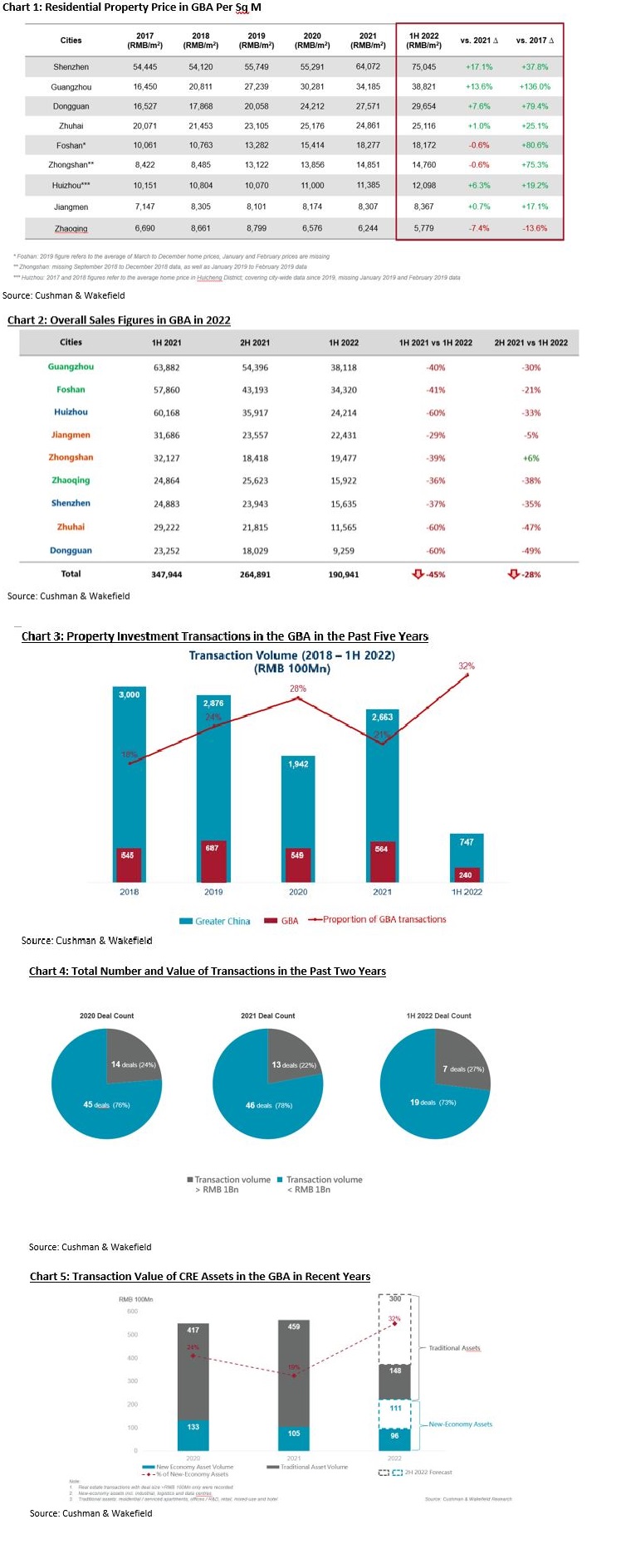

Residential Price and Sales Volume in the GBA

Amongst all GBA cities, residential property prices in Guangzhou and Shenzhen have shown outstanding performance, while the other seven cities remained stable. The two major cities of Shenzhen and Guangzhou have recorded RMB75,045 and RMB38,821 per sq m, representing a y-o-y increase of 17.1% and 13.6%, respectively. Other cities such as Foshan and Dongguan have recorded an approximately 80% increment since 2017, with Guangzhou showing a 136% rise (Chart 1). The impact of the pandemic, and the recent government control measures in Shenzhen and Guangzhou, resulted in pre-sale and supply of premium and luxury properties instead of mid-range priced stocks. As a result, the noticeable rise in property prices masked the declining trend of transaction volume in all cities.

From the sales data, the overall sales figures and residential property prices in the GBA have moved in opposite directions in 1H 2022. The number of first- and second-hand transactions have totalled around 190,000, a fall of 45% y-o-y. Although being the highest among the GBA cities, the sales figures of Guangzhou and Foshan were still behind the performance at the same time last year. The drop was most obvious for Huizhou, Zhuhai, and Dongguan, at 60% y-o-y.

Alva To, Cushman & Wakefield's Vice President, Greater China & Head of Consulting, Greater China mentions, "The increment of first-and-second-hand residential property prices in the GBA in 1H 2022 was driven by transactions of premium and luxury properties, while we expect the price to remain stable throughout the year. Despite a plunge in overall transaction volume in 1H 2022, we expect the transaction volume to increase by 5% to 10% as the government's control measures ease."

GBA CRE Investment Transaction Number and Value

Since the launch of the Framework Agreement on Deepening Guangdong-Hong Kong-Macao Cooperation in the Development of the Greater Bay Area in 2017, CRE transactions have become more active, gradually increasing CRE's share of investment in Greater China. Despite the impact of the pandemic, the total national transaction value was recorded at RMB74.7 billion in 1H 2022. Large size transactions in the GBA attributed to 32% of the Greater China share, hitting a five-year high since 2018 (Chart 3), showing the increased investment traction. The total annual transaction value is expected to reach RMB65.5 billion for the full year 2022.

Transaction Value and Distribution of Investors

In terms of transaction value, most transactions in the GBA were smaller value deals. Of the 26 deals recorded in 1H 2022, 19 of them were below RMB1 billion, accounting for 73% of the deal count (Chart 4). As for the source of market capital, transactions from foreign capital plunged by 80% y-o-y. Transactions by foreign capital amounted to RMB8.6 billion in 1H 2021 but only RMB1.8 billion in 1H 2022, while those by domestic investors reached RMB22 billion. This shows investors' optimism towards the future of the CRE investment market.

Investment Types by CRE Assets in the GBA

Charli Chan, Cushman & Wakefield's Executive Director, Capital Markets, China shared, "Investors have become cautious about traditional assets, with self-use making up close to 90% of the office investors. Meanwhile, investment in new economy assets such as industrial, logistics and data centres has significantly increased (Chart 5) and will likely reach RMB20 billion in 2022. At the same time, the total transaction value in the GBA will likely reach around RMB65.5 billion in 2022."

Property transactions in Shenzhen and Guangzhou have remained active amongst the GBA cities in 1H 2022, with Shenzhen achieving 15 large-size transactions totalling RMB11.55 billion, while Guangzhou recorded 10 large-size transactions totalling RMB12.1 billion. This figure has also broken a new record and marked a five-year high in the local market. In Shenzhen, industrial property transactions made up 73% of the total and recorded a six-fold increment y-o-y. Amongst the transactions were those from biotechnology, logistics, data centres, and traditional banking and insurance industries, demonstrating a diversified array of CRE investment sources in the GBA.

Alva To, Cushman & Wakefield's Vice President, Greater China & Head of Consulting, Greater China concluded, "The enhancement of the transportation infrastructure network in core cities in the GBA has resulted in increased demand for logistic assets in Guangzhou, Shenzhen and Dongguan; and brought about greater prosperity and integration to other GBA cities. Apart from traditional properties such as offices and shopping centres, we also expect new economy properties such as industrial logistics, industrial parks, and data centres to join the limelight in the CRE investment market in the GBA. In addition, development plans around the GBA such as the Northern Metropolitan and Qianhai will gradually gain more attention from investors and bring about a greater platform and interest in future investment opportunities."

Please click here to download photos and materials.

Photo description: Charli Chan, Cushman & Wakefield's Executive Director, Capital Markets, China (on the left), and Alva To, Cushman & Wakefield's Vice President, Greater China & Head of Consulting, Greater China (on the right).

Hashtag: #CushmanWakefield

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 50,000 employees in over 400 offices and 60 countries. Across Greater China, 23 offices are servicing the local market. The company won four of the top awards in the Euromoney Survey 2017, 2018 and 2020 in the categories of Overall, Agency Letting/Sales, Valuation and Research in China. In 2021, the firm had revenue of $9.4 billion across core services of property, facilities and project management, leasing, capital markets, valuation, and other services. To learn more, visit www.cushmanwakefield.com.hk or follow us on LinkedIn ( https://www.linkedin.com/company/cushman-&-wakefield-greater-china).