Reserve Bank and government prepare fresh emergency measures as markets tumble

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

The government is planning to deliver a second coronavirus economic support package within days, and the Reserve Bank will announce “further policy measures[1]” to support the economy on Thursday.

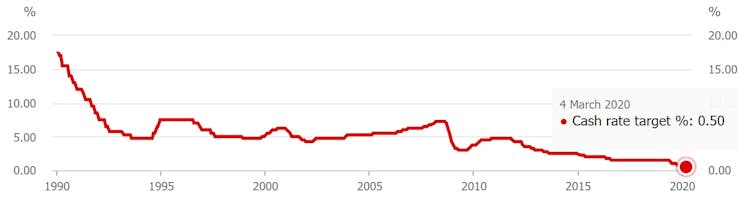

The bank sometimes uses the phrase “policy measures” to describe adjustments to its “policy rate”, the so-called cash rate from which most other rates are priced.

Two weeks ago it cut the cash rate to 0.50%, a record low that is only 0.25 points above what Governor Philip Lowe has described as the effective lower bound[2] of 0.25%, beneath which the bank would need to engage in “unconventional monetary policy[3]” which would involve buying government bonds, residential mortgage bonds and perhaps corporate bonds to force a suite of longer-term interest rates lower.

At Thursday’s announcement Governor Lowe is also likely to take the opportunity to set out in detail how unconventional measures would be applied.

Reserve Bank cash rate

The Australian share market crashed 9.7% on Monday in its worst one-day sell-off since 1987.

In an emergency meeting earlier on Monday New Zealand’s Reserve Bank slashed its cash rate by 0.75 points from 1.00% to 0.25% and said it will remain at that level for at least the next 12 months[4].

Should it need to do more, it would turn to unconventional measures along the lines of those being planned for in Australia and implemented in the United States and Europe.

On Sunday, the US Federal Reserve cut its benchmark interest rate to zero[5] and launched a new round of unconventional measures saying it would buy US$700 billion of government, corporate and mortgage-backed securities.

Read more:

Now we know. The Reserve Bank has spelled out what it will do when rates approach zero[6]

Mid-Monday Australia’s Reserve Bank and the Council of Financial Regulators[7] which is made up of the bank, the Prudential Regulation Authority, the Securities and Investments Commission and the Commonwealth Treasury, announced a series of measures to keep financial markets working after investors turned away from both shares and government bonds.

Normally when investors desert shares they buy government bonds, forcing down the interest rates quoted on the bonds.

But in both the US and Australia, investors have sold bonds as well, pushing up the rate (almost doubling the yield on a 10 year Australian government bond from 0.6% last Monday to 1.1%) and starving the market of buyers at any price, a phenomenon the council of regulators describes as a deterioration in liquidity[8].

The Reserve Bank has acted to inject liquidity by promising to buy unlimited amounts of one-month and three-month securities until further notice.

Read more:

We're staring down the barrel of a technical recession as the coronavirus enters a new and dangerous phase[9]

The Australian Prudential Regulation Authority said it would ensure banks take advantage of the injection of liquidity to support their customers.

Both the Authority and the Securities and Investments Commission will be flexible in applying rules where those would cause hardship to businesses and customers.

In particular, each agency will, where warranted, provide relief or waivers from regulatory requirements. This includes requirements on listed companies associated with secondary capital raisings, annual general meetings and audits.

The Tax Office[10] earlier announced a series of administrative measures to assist people and businesses in difficulty as a result of the coronavirus including deferring the payment date of amounts due through the business activity statement and income tax assessments by up to four months.

The government’s second coronavirus support package follows a package of A$17.6 announced on last Thursday.

Read more:

This coronavirus share market crash is unlike those that have gone before it[11]

It will be aimed at shoring up business and households affected by new travel and isolation rules announced on Sunday[12].

A skeleton parliament will meet for a few hours next week to approve measures announced in the first and possibly the second stimulus package. Members will be paired to ensure that only those needed for quorums will be present.

The Australian share market crashed 9.7% on Monday in its worst one-day sell-off since 1987.

In an emergency meeting earlier on Monday New Zealand’s Reserve Bank slashed its cash rate by 0.75 points from 1.00% to 0.25% and said it will remain at that level for at least the next 12 months[4].

Should it need to do more, it would turn to unconventional measures along the lines of those being planned for in Australia and implemented in the United States and Europe.

On Sunday, the US Federal Reserve cut its benchmark interest rate to zero[5] and launched a new round of unconventional measures saying it would buy US$700 billion of government, corporate and mortgage-backed securities.

Read more:

Now we know. The Reserve Bank has spelled out what it will do when rates approach zero[6]

Mid-Monday Australia’s Reserve Bank and the Council of Financial Regulators[7] which is made up of the bank, the Prudential Regulation Authority, the Securities and Investments Commission and the Commonwealth Treasury, announced a series of measures to keep financial markets working after investors turned away from both shares and government bonds.

Normally when investors desert shares they buy government bonds, forcing down the interest rates quoted on the bonds.

But in both the US and Australia, investors have sold bonds as well, pushing up the rate (almost doubling the yield on a 10 year Australian government bond from 0.6% last Monday to 1.1%) and starving the market of buyers at any price, a phenomenon the council of regulators describes as a deterioration in liquidity[8].

The Reserve Bank has acted to inject liquidity by promising to buy unlimited amounts of one-month and three-month securities until further notice.

Read more:

We're staring down the barrel of a technical recession as the coronavirus enters a new and dangerous phase[9]

The Australian Prudential Regulation Authority said it would ensure banks take advantage of the injection of liquidity to support their customers.

Both the Authority and the Securities and Investments Commission will be flexible in applying rules where those would cause hardship to businesses and customers.

In particular, each agency will, where warranted, provide relief or waivers from regulatory requirements. This includes requirements on listed companies associated with secondary capital raisings, annual general meetings and audits.

The Tax Office[10] earlier announced a series of administrative measures to assist people and businesses in difficulty as a result of the coronavirus including deferring the payment date of amounts due through the business activity statement and income tax assessments by up to four months.

The government’s second coronavirus support package follows a package of A$17.6 announced on last Thursday.

Read more:

This coronavirus share market crash is unlike those that have gone before it[11]

It will be aimed at shoring up business and households affected by new travel and isolation rules announced on Sunday[12].

A skeleton parliament will meet for a few hours next week to approve measures announced in the first and possibly the second stimulus package. Members will be paired to ensure that only those needed for quorums will be present.

References

- ^ further policy measures (www.rba.gov.au)

- ^ effective lower bound (www.rba.gov.au)

- ^ unconventional monetary policy (www.rba.gov.au)

- ^ at least the next 12 months (www.rbnz.govt.nz)

- ^ to zero (www.cnbc.com)

- ^ Now we know. The Reserve Bank has spelled out what it will do when rates approach zero (theconversation.com)

- ^ Council of Financial Regulators (www.cfr.gov.au)

- ^ deterioration in liquidity (www.cfr.gov.au)

- ^ We're staring down the barrel of a technical recession as the coronavirus enters a new and dangerous phase (theconversation.com)

- ^ Tax Office (www.ato.gov.au)

- ^ This coronavirus share market crash is unlike those that have gone before it (theconversation.com)

- ^ announced on Sunday (theconversation.com)

Authors: Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University