who gets the imputation cheques Labor will take away?

- Written by Ben Phillips, Associate Professor, Centre for Social Research and Methods, Director, Centre for Economic Policy Research (CEPR), Australian National University

Labor is banking on about A$5 billion per year from ending the cash payment of company tax refunds to dividend holders who don’t pay tax[1].

It’ll exempt charities, non-profits, pensioners and part pensioners and other Australians on government allowances, including future pensioners. Self-managed super funds that had pensioner members at the time Labor announced its policy will also be spared.

So who’s left? Are they battlers on genuinely low incomes (as might be inferred from the low taxable incomes that enable them not to pay tax), or are they a good deal more wealthy?

The Coalition says they are mainly genuine low income earners. According to Treasurer Josh Frydenberg[2]

over 80 per cent of people who are relying on their cash refunds have a taxable income under $37,000

Yet Labor’s Chris Bowen[3] says they are

typically wealthier retirees who aren’t paying income tax - these are people who typically own their own home and also have other tax-free superannuation assets, and don’t pay tax on their superannuation income

There are two main ways in which people receive company tax refunds that are paid in cash rather deducted from their tax bill.

One is through self-managed super funds that don’t pay tax during the retirement phase. Around 55 per cent of excess refunds are paid out in this way according to our modelling.

The other is through payments made directly to Australians who own Australian shares in their own name but pay insufficient tax to make use of credits of company tax paid creasting their dividends. These people are oft

For investors it makes sense to have the investment in the name of the person with the lowest taxable income ensuring that tax paid on investment returns is minimised or, even better, rebated through franking credits.

Retirees can have low taxable incomes even when their actual incomes are high because of decisions to exempt superannuation income from income for tax purposes.

Read more: Words that matter. What’s a franking credit? What’s dividend imputation? And what's 'retiree tax'?[4]

Modelling[5] just completed by the Australian National University Centre for Social Research and Methods gets around this by using the household income figures collected by the Bureau of Statistics.

Household income is arguably a better guide to who benefits from shares that are typically held in the name of the lowest taxed member. Household income also includes superannuation income whether it is taxed or not.

Our findings are presented in 2019 dollars and is based on a mature policy in the sense that all behaviour changes have occurred. We do this by aligning our numbers to the Parliamentary Budget Office who attempt to account for behaviour changes such as altered investments. We accept that such changes are subject to considerable uncertainty but expect the distribution of results to be relatively robust regardless.

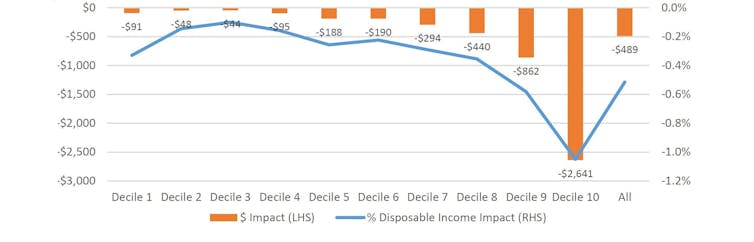

Across all households, regardless of whether they receive franking credits, the average impact from removing the credits is $489 per year, or about 0.5% of disposable income.

But the impact of Labor’s policy is heavily concentrated in households in the top 10% (decile 10) of household incomes. These households pay additional tax of $2,641 per year (1.1% of their disposable income) averaged across all households in the top decile.

There is virtually no impact on households in the bottom half of the income distribution.

Impact of proposed changes to franking credit policy on annual household disposable income by equivalised income decile, 2019 dollars

Decile 1 is the lowest income decile and decile 10 the highest.

Source: PolicyMod, ANU[6]

Decile 1 is the lowest income decile and decile 10 the highest.

Source: PolicyMod, ANU[6]

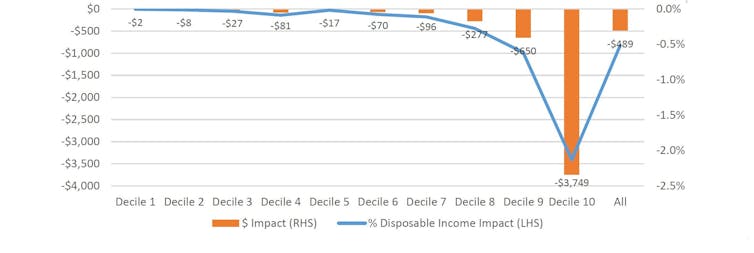

The impact is even more skewed when considered by wealth distribution of households.

Labor’s changes would have virtually no impact across the bottom 70% of the wealth distribution. Almost 90% of the total value of all imputation cheques are paid to the top 20% of the wealth distribution.

Around 2.7% are paid to the bottom 50%.

Impact of proposed changes to franking credit policy on annual disposable household income by wealth decile, 2019 dollars

Decile 1 is the lowest income decile and decile 10 the highest.

Source: PolicyMod, ANU[7]

Decile 1 is the lowest income decile and decile 10 the highest.

Source: PolicyMod, ANU[7]

Overall, around 6.5% of households would be negatively impacted (around 600,000 households). The vast majority have high income and high wealth.

For those low income or low wealth households that are affected, the impact tends to be relatively small. As an example, for the least wealthy 10%, the average financial impact is $686 per year. For the most wealthy it is nearly $12,000 per year.

The current arrangements around franking credits and superannuation leads to significant leakage in the tax system. Whether removing excess franking credits is the solution to this problem is debatable, but it remains the case that the majority of franking credit refunds are received by high income and/or high wealth households who ideally would be paying at least some tax on this income.

Reforming such leakage in the tax system provides room for other tax reforms in personal income and company tax that many economists argue offer more promise in providing incentives to work and invest.

References

- ^ to dividend holders who don’t pay tax (theconversation.com)

- ^ Josh Frydenberg (www.npc.org.au)

- ^ Chris Bowen (www.chrisbowen.net)

- ^ Words that matter. What’s a franking credit? What’s dividend imputation? And what's 'retiree tax'? (theconversation.com)

- ^ Modelling (csrm.cass.anu.edu.au)

- ^ Source: PolicyMod, ANU (csrm.cass.anu.edu.au)

- ^ Source: PolicyMod, ANU (csrm.cass.anu.edu.au)

Authors: Ben Phillips, Associate Professor, Centre for Social Research and Methods, Director, Centre for Economic Policy Research (CEPR), Australian National University